State of play

Green shoots of recovery

India’s GDP (gross domestic product) grew modestly -- over 20 percent year on year in the first quarter (Q1, Apr-June 2021) but still below pre-Covid output level. Investment in Q1 increased by 55 percent in inflation-adjusted terms, 17 percent lower than the same quarter in 2019 and exports clocked a strong 39 percent growth over the same period of 2020. 43 percent of India’s population received at least one vaccination shot as of September 18, 2021. And while final data for Q3 was not available, unexpected surges in demand for electricity and fuel, accompanied by shortages of both metallurgical and thermal coal, suggested a powerful growth spurt.

US Special Presidential Envoy for Climate John Kerry visited India to discuss US-India cooperation on climate change with Prime Minister Narendra Modi. While there was no breakthrough over a net zero commitment – a central component of Kerry’s overall Glasgow strategy - the two countries launched a ‘Climate Action and Finance Mobilisation Dialogue (CAFMD)” designed to help India with its target of achieving 450 GW of renewable energy by 2030.

India’s Climate Vulnerability

Natural Disasters Intensify

In the first seven months of this year India experienced two cyclones and a deadly glacier collapse in the Himalayas. There were several calls for terminating hydro-power projects in the upper reaches of the Himalayas with 64 prominent environmental activists and academicians, including two Rajya Sabha MPs and other notable leaders, sending an open letter to the government. Six out of these seven hydro-electric projects underway in the upper reaches of the Ganga River lie in the para-glacial zones or its buffers, which ecologists have warned need to be kept inviolate. In the monsoon season, torrential rains in India's west coast triggered landslides and a deluge of sludge, leaving more than 75 dead.

Climate Diplomacy

India takes steps to reduce key greenhouse gases

India ratified the Kigali Amendment earlier this year, giving the amendment a total of 123 ratifications so far. A national strategy for phase down of hydrofluorocarbons (HFCs) will be developed after consultation with industry stakeholders by 2023. To ensure compliance with the Kigali Amendment, amendments to the existing Ozone Depleting Substances Rules, to allow appropriate control of the production and consumption of hydrofluorocarbons, will be done by mid-2024. The phasedown is expected to prevent the emission of up to 105 million tonnes of carbon dioxide equivalent of greenhouse gases, helping to avoid up to 0.5 degree Celsius of global temperature rise by 2100, while continuing to protect the ozone layer.

There was an expectation that India might join the Global Methane Pledge announced by the US and Europe in September (officially to be launched in COP26) when PM Modi visited the US, but it didn’t materialise. However, India is a member of the global methane initiative, and the new Pledge would work in tandem with and support GMI. China, the United States, Russia, India, Brazil, Indonesia, Nigeria and Mexico are estimated to be responsible for nearly half of all anthropogenic methane emissions. The largest share of India’s methane emissions is from India’s livestock population, considered the world’s largest at over 850 per 1000 population is a significant contributor to global methane emissions. Methane reductions from livestock are considered among the most challenging to reduce sharply, by comparison with either rice or oil and gas production.

At the 2021 Clean Energy Ministerial (CEM) India and the UK launched a new workstream to promote industrial energy efficiency under the CEM Industrial Deep Decarbonization Initiative (IDDI). The IDDI aims to infuse green technologies and stimulate demand for low-carbon industrial material. India’s commitment to cut emissions intensity per unit of GDP by 33-35 per cent by 2030 hinges on the effective deployment of low carbon technologies in energy-intensive sectors like iron and steel, cement and petrochemicals.

At the Major Economies Forum on Energy and Climate (MEF) in September, India’s Minister for Environment, Forest and Climate Change, Bhupender Yadav stated the need for world-wide “rapid, sustained, and deep emission cuts in this decade” rather than setting distant targets like net zero by 2050. He highlighted India’s leadership in combating the climate challenge through ambitious RE-based energy transitions and the importance of climate justice based on the fundamental principles of equity and common but differentiated responsibilities and respective capabilities (CBDR). The CBDR principle in UNFCCC is a long-held position of India to underscore the divergence in economic status between developed and developing countries and to ensure proportional climate responsibilities.

Clean Energy Transition

Costs set to increase for solar projects

The total installed renewable energy (RE) capacity in India (not including large hydro) crossed 100 GW in August, a year ahead of the 2022 target. India now has the 4th largest installed RE capacity, 5th largest solar generation capacity and the 4th largest wind generation capacity. According to a government press release, an additional 50 GW is under installation and 27 GW is under tendering. If large hydro is included the installed RE capacity increases to 146 GW. RE (not including large hydro) is now the second largest after coal in installed capacity, and there are urgent efforts underway to cross the 150 GW benchmark.

Emboldened by the achievement, PM Modi made official the target of 450GW RE capacity by 2030 by announcing it in his speech to UNGA. This target is the prime offer in India’s Energy Compact submitted to the UN in September.

There is an upward trend in solar project costs partly because of the increase in module prices in the global market. This could affect projects that were won based on very low costs and slow down India’s progress in meeting solar energy targets. In Q2 2021, the lowest bid of US₵ 3.3/kWh (INR 2.51/ kWh) was about 14 percent higher than the lowest discovered of US₵2.9/kWh (INR 2.2/kWh) in the previous quarter. Chinese modules were about 28 percent more expensive in India in that same quarter. The 40 percent increase in basic customs duty (BCD) in April 2022 is likely to increase capital cost by 23-24 percent. The solar industry is also witnessing arbitrary price hikes and renegotiation of supply contracts by module manufacturers, putting the already stressed under-construction projects at huge risk. Many analysts feel that it is hard to justify low winning bid levels. Investment enthusiasm is probably running ahead of fundamentals and clouding objective risk assessment. Equipment prices would need to come down by 35-40 percent for some of these projects to be viable.

This once again highlights the critical importance of securing reliable, and cost-effective solar supply chain for India, an area philanthropy hasn’t focussed on much thus far.

Source: Power System Operation Corporation POSOCO

Germany has joined the International Solar Alliance (ISA, headquartered in India). Germany’s membership in the ISA will boost India’s ambitious cross-border power grid plan, the One Sun One World One Grid, which seeks to transfer solar power generated in one region to feed the electricity demands of others, as China attempts to co-opt countries into its One Belt One Road initiative. The Director-General of ISA, Ajay Mathur, said that an economic pre-feasibility report on solar global grid will be available soon. There is increasing speculation that the USA may also join ISA.

Source: Bridge to India, PVinfolink

Impressive Response to Production Linked Incentive Program for Solar Manufacture

Solar installation in India is currently dependent upon imported solar PV cells and modules. The domestic solar manufacturing capacity is only 3-4 GW for solar cells and about 15 GW for solar modules.

The Ministry of New & Renewable Energy (MNRE) invited bids under the production-linked incentive (PLI) program - National Programme on High Efficiency Solar PV (Photovoltaic) Modules - for setting up solar manufacturing units. The call received an overwhelming response of 54.8 GW worth of bids against a total bid capacity of 10 GW, resulting in over four-fold over-subscription. The financial outlay for this PLI program is $600 million over a five-year period. Along with the addition of 10 GW capacity of integrated solar PV manufacturing plants, the program is expected to attract direct investment of around $2 billion in solar PV manufacturing projects, spur demand of over $3 billion over 5 years for 'Balance of Materials', provide direct employment of about 30,000 and indirect employment of about 1,20,000 persons and facilitate import substitution of around $3 billion every year.

A who’s who of major Indian industrial firms bid: Reliance New Energy, Adani Infrastructure, Jindal India Solar, Shirdi Sai Electricals and First Solar India, Coal India, Larsen and Turbo, ReNew Power, Tata Power Solar, Waaree Energies, Vikram Solar, Avaada Energy, Acme Solar, Premier Energies, Megha Engineering, Jupiter Solar and Emmvee PV all placed bids.

Hydrogen joins India’s decarbonisation drive

The Indian PM announced a Hydrogen Mission with the goal of making India a global leader in green hydrogen. Incentives like those offered to RE are also being considered to boost green hydrogen production. India is planning to make purchase of green hydrogen mandatory for user industries with such purchases counted as renewable purchase obligation (RPO). Large publicly owned companies such as Indian Oil, National Thermal Power Corporation and others have lined up plans to build green hydrogen plants and hydrogen fuelling stations. The US-based Ohmium company has launched plans for India's first green hydrogen electrolyser Gigafactory. Reliance Industries India’s largest conglomerate has said that it will bring down the cost of green hydrogen to less than $1/kilogram.

In a seeming contradiction, the government constituted a task force to study coal-based hydrogen production. This has caused concern that most of the hydrogen will come from natural gas, increasing India’s import dependence, and delaying full decarbonization of the converted industrial sectors.

There is uncertainty within the Indian government of the relative importance of manufacturing hydrogen vs. more mature clean energy technologies like solar cells and batteries. The CEO of Niti Aayog, the government’s in-house think tank publicly stated that India should resist the temptation of competing with mature technology manufacturers in Asia and instead focus on hydrogen.

New Effort to Reform India’s Transmission utilities

The ‘reforms-based and results-linked, revamped distribution sector’ (RRRD) program was approved by the government for the revival of transmission utilities finances. The policy seeks to improve the operational efficiencies and financial sustainability of all public sector utilities through financial assistance for investing in better power distribution technology including smart meters. Several financial criteria and basic minimum benchmarks provide the framework that will qualify utilities for assistance. According to the government, implementation of the program will be based on the action plan worked out for each state rather than a “one-size-fits-all” approach. The program has an outlay of over $44 billion.

One main concern is the fact that while there are new conditions, evaluation matrix and differential approach to discoms, (which are improvements), most of the performance metrics mirror the previous programs. This creates the risk of another failure. It is too early to predict the probability of success, but the hope is that the centre and states would work much more closely and beyond political considerations to resolve long lingering structural issues.

Progress on KUSUM

One main objective of the new reform program is to improve the electricity supply for the farmers through separation of agriculture feeders for providing daytime electricity to them from distributed solar financed by the KUSUM program (a program to solarise diesel irrigation pumps). But there are design concerns about the scalability of KUSUM. Under KUSUM, most auctions have set a ceiling of less than US₵ 4/kWh which is not commercially viable according to developers. The auctions are also considered high-risk, with no payment security mechanism clause in place for developers. Developers are concerned about the utility track record of making timely payments under their power purchase agreements.

Many farmers who were successful in their bids lacked the financial means to contribute 30 percent of the project’s equity. Even if farmers raise equity, getting a loan from a bank has proven difficult, since banks want collateral in the absence of third-party assurances. Furthermore, due to utilities poor payment track record, banks are unwilling to take the risk without alternative collateral.

Some states already have state-level plans to promote the use of solar energy in this sector. These states were reluctant to merge their programs with a central program and allow the Centre to claim credits to encourage farmers to use solar energy. Overall, while KUSUM has noble intentions and strong climate rationale, there are shortcomings in the implementation including alignment with the larger utility reform program. Philanthropy should examine playing a role in this space.

Coal generation and mining

Coal demand remains robust

Coal continues to remain important in India’s energy portfolio, accounting for about 80 percent of generation in 2020-21. However, at the time of developing this Update, India is going through a severe coal shortage crisis with alarm bells ringing across the government about massive outages. While the power minister assured the nation of an easing of the situation, several state governments are sending SOS to central government about impending dark days. This situation may have far reaching implications for the energy transition debate as there are cases to be made on both, a) more mining and import of coal b) more aggressive clean energy transition. However, in the short term, securing coal supply and storage will weigh heavily in the decision making (China for example has increased coal mining to meets its own power shortages). The government has already asked generators to import coal and ordered private miners to ramp up production. Coal stocks remain marginal in many plants.

According to data from Global Energy Monitor (GEM), while India has cancelled or retired 590 GW of coal plants since 2010, there are coal power projects of 60 GW under various stages of construction, representing 15 percent of the global development pipeline. Some recent research highlights the financial costs and risks associated with these including the cost of retrofitting plants older than 20 years to achieve compliance.

Coal India Ltd is planning to raise prices of coal by at least 10-11 per cent to mitigate the impact of increased costs and an impending wage revision. There has been no price rise in coal in the fuel supply agreements (FSA) since the last few years. The wage revision, which is due from July this year, is likely to cost the miner an additional $1 billion. This is not likely to result in an increase in the consumer price for coal-based power.

Transportation and electrification

Government Auto Aid Focusses on EV’s: E Two Wheelers Take Off

India has plans to give about $3.5 billion in incentives to auto companies over a five-year period under a revised program to boost the manufacturing and export of clean technology vehicles. The original proposal did not focus nearly as heavily on EV’s and other zero emission vehicles. Some see this as the response to Tesla lobbying for lower import taxes for EVs. The program is part of India's broader $27 billion programme to attract global manufacturers. Under the revised program, companies that qualify will get cashback payments equivalent to around 10-20 percent of their turnover for EVs and hydrogen fuel cell cars. Carmakers would need to invest a minimum of about $272 million over five years to qualify for the payments. Auto parts makers will get incentives to produce components for clean cars and for investing in safety-related parts and other advanced technologies like sensors and radars used in connected vehicles.

India is one of the few countries that support the global EV30@30 campaign, which targets to have at least 30 percent electrification of its new vehicle sales by 2030. The push takes the form of incentives offered under the FAME-II program, waiving-off of registration fees and road tax by many states.

Source: SMEV, Society for Manufacture of Electric Vehicles, Vahan Dashboard

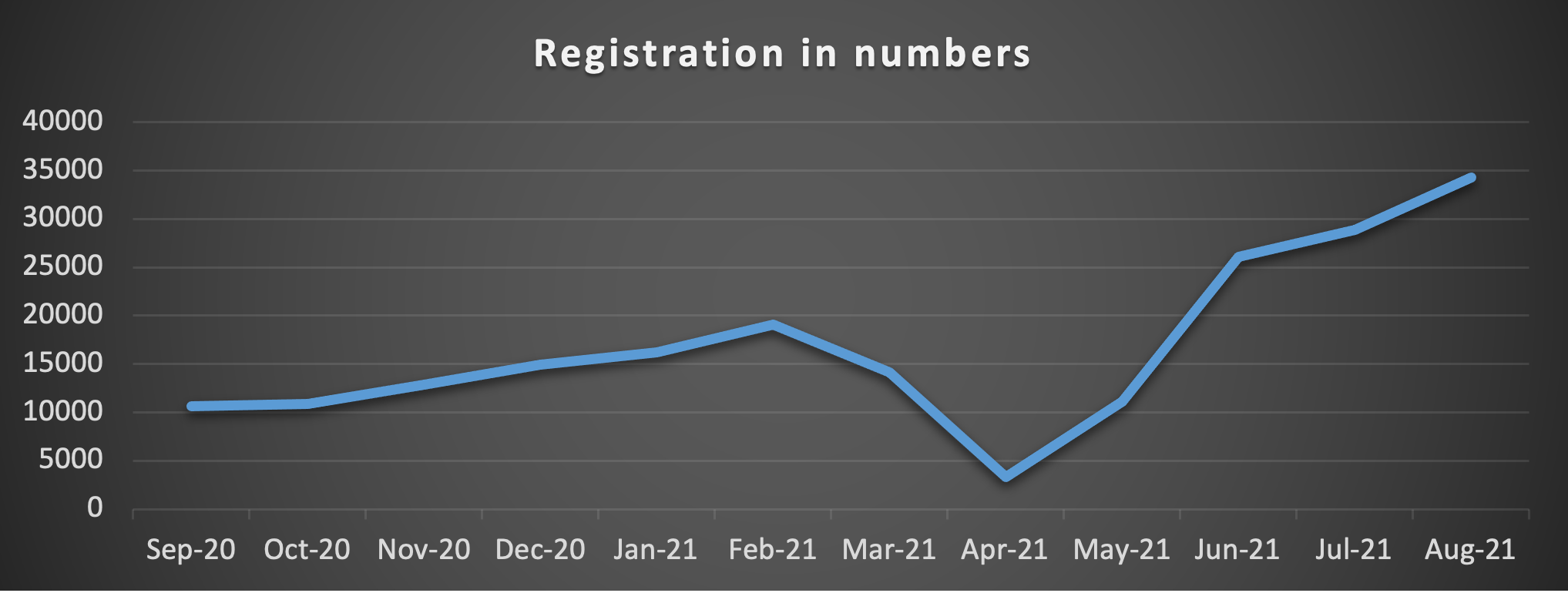

The year-on-year increase in registrations of EVs in India during the last 4 years (except during 2020) is a positive sign. At 145,061 registrations by August 2021, the share of EVs in total vehicle registrations this year (till August) doubled to 1.4 percent from 0.7 percent last year. The registration for high-speed (HS) electric two-wheelers (E2W) grew by more than 120% until August this year compared to 2020 and their share in total 2W registrations this year (till August) more than tripled to 0.78 percent from 0.21 percent last year. A similar pattern is absent for registered electric three-wheelers (E3W) that account for more than 65 percent of overall registered EV sales in India. On the other hand, electric car (E-Car) registrations, which have been abysmal compared to E2W and E3W, witnessed a 40 percent growth in number of registrations till August 2021 over the last calendar year.

One of the factors behind this rise is the pent-up demand from the months of April, May, and June when the second wave of Covid likely led to an overall decline in registrations. The other major factor driving registrations is the introduction of additional FAME II subsidies in June this year. 350 EV charging stations have been installed under FAME program. Ola Electric, the ride-hailing firm's electric vehicle arm sold e-scooters worth over $150 million in just two days. It represented one of the highest sales in a day (by value) for a single product in Indian e-commerce history. Overall, 13 states have approved, notified dedicated EV policies.

Source: SMEV, Society for Manufacture of Electric Vehicles, Vahan Dashboard

A fast emerging – if somewhat submerged yet – and critical segment for electrification is Heavy Duty Vehicles, particularly trucks. Electrification of road freight transportation is significant given its massive consumption of imported and expensive diesel and heavy share of PM2.5 pollution. With a soaring economy and emphasis on domestic manufacturing, the movements of goods by road will see a quantum leap. Therefore, a discussion on electrification of trucks, particularly enabling policies including something akin to California’s ACT framework, technical support, analysis and capacity building are of importance to India. India’s NITI Aayog and Electric Mobility Initiative (EMI) partner RMI have already flagged this important area of work and philanthropy has taken a lead to support it. A broader set of stakeholders is needed to be part of this effort.

A cloud hangs over pending but not yet implemented fuel economy and vehicle emission standards. Carmakers, as was expected, have said it would be difficult to make further investments to meet the stricter rules, particularly as profits have been hit by slumping sales over the last two years. The corporate average fuel efficiency (CAFE) rules require automakers to cut average carbon emissions, turning to strategies such as launching electric cars or vehicles using alternative fuels like ethanol. India introduced a first phase of its CAFE measures in April 2017, giving carmakers until the end of March next year to cut carbon emissions from new cars to 130 grams/kilometre (g/km). In a second phase starting from April 1, 2022, India has proposed a further cut to 113 g/km. With air quality becoming a public health issue and transportation being a main source, the case for stricter emission rules is more compelling now than ever before. Stricter CAFE rules also aim to align Indian regulations for carmakers with global standards. In both Europe and California, stringent emission and economy standards have been significant drivers of electric vehicles, and this is a tool India is likely to need for rapid electrification of transport.

Clean Air, Energy Access and Grass-roots energy and climate politics

Slow progress in combating pollution

The WHO issued new norms for ambient air quality. The whole of India falls well above these WHO prescribed limits of pollutants. But there are signs of positive action against pollution in cities. For example, as Delhi’s air quality is predicted to deteriorate from October, Delhi Pollution Control Committee will restrict the use of “dirty fuels” within the industries, burning of tyres, diesel generators with no emission management gadget and flouting norms for disposal of construction and demolition waste. Over 1,600 industries in and around Delhi switched to cleaner PNG (pressurised natural gas) after pipelines were installed in the industrial area. The Delhi government however, presumably to mitigate risks to upcoming state elections, withdrew its petition from the Supreme Court seeking directions to 10 coal-fired thermal power plants in Uttar Pradesh, Punjab and Haryana to cease operations till Flue Gas Desulphurization technology is installed.

The Government of India, the Central Water Commission, government representatives from 10 participating states and the World Bank signed a $250 million project, to support the Government of India’s long-term dam safety program and improve the safety and performance of existing dams across various states of India.

Source: WHO for WHO revised air quality guidelines and Central Pollution Control Board (CPCB) for India