Background Paper No. 32

BY ABHISRI NATH & JEFFREY D. BEAN

I. INTRODUCTION

In modern advanced technology manufacturing, for everything from semiconductors to cars to clean energy tech, certain inputs, in particular processed metals, remain essential for which there are currently no substitutes. According to the American Geosciences Institute, critical minerals are, “mineral resources that are essential to the economy and whose supply may be disrupted.” Concentrated critical mineral supply chains represent a significant risk for the United States and its partners and allies, because there are few alternatives, and developing new sources can take years if not decades. Against the backdrop of geopolitical competition between the United States, along with its partners and allies, and the People’s Republic of China, the risks of damaging economic impacts from export controls on critical minerals and their respective markets and supply chains are a key policy concern.

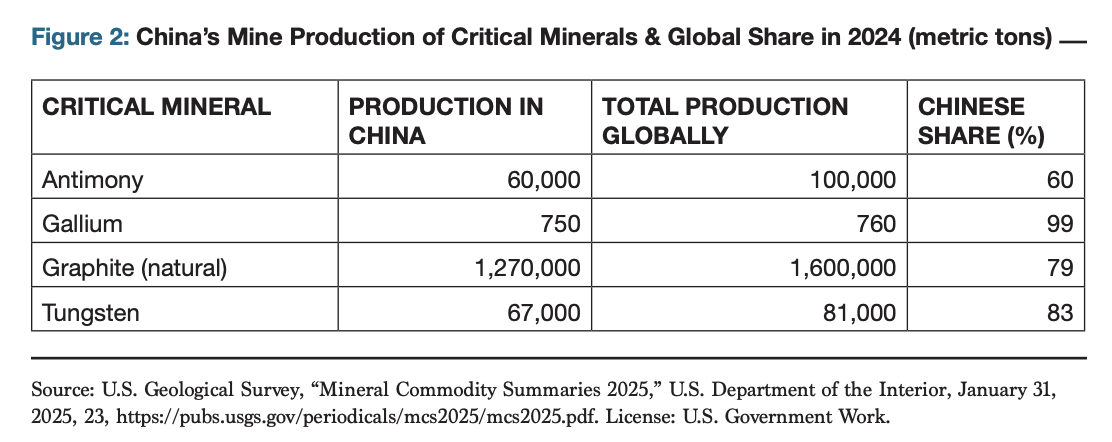

The 2023-2025 export controls on key critical minerals including germanium, gallium, graphite, and antimony by the People’s Republic of China (PRC) highlight China’s strategic use of its dominance in extraction and processing in critical mineral supply chains as a geopolitical tool. The subsequent export bans on germanium, gallium, and antimony to the United States and U.S. companies demonstrate Beijing’s willingness to squeeze on these chokepoints. The restrictions on germanium and gallium may not impact the United States as severely as restrictions on antimony and graphite due to diversification of suppliers in the respective supply chains and lower volume of required inputs. However, the PRC’s actions underscore its ability to use economic tools as a means of coercion and signaling to shape trade and market circumstances to be more favorable to China. Secure supply of critical minerals also represents a potential point of failure in broader allied efforts to build resilient supply chains for critical and emerging technologies.

The picture on China’s export controls of minerals has changed in a short time. On July 3, 2023, the PRC’s Ministry of Commerce (MOFCOM) announced export controls on gallium and germanium, which required buyers to submit details about the end-use of their purchase for export and then await a license to complete export of the purchase. They followed a significant reorganization, update, and expansion of China’s export control regime and economic statecraft bureaucracy. On October 20, 2023, the Ministry of Commerce followed up with similar end-user and purchaser licensing requirements for exports of graphite, which went into effect in December 2023. On August 15, 2024, the PRC announced export restrictions on dual-use exports of antimony, which went into effect on September 15. In November 2024, MOFCOM announced a new dual-use export control regime, citing national security concerns over weapons of mass destruction. T his included critical minerals and was followed by export bans on gallium, germanium, and antimony on December 3, 2024. MOFCOM also imposed stricter restrictions on graphite. Most recently, in response to U.S. tariffs, Beijing announced retaliatory tariffs on various products as well as export controls on five additional minerals, including tungsten on February 4, 2025, and then on seven rare earth elements on April 4, 2025.

This analysis covers the uses of these critical minerals, briefly gauges the extent of China’s control over each and describes ongoing responses, provides a detailed case study of the vulnerability of the graphite supply chain, where U.S. dependency on Chinese sources is high, and then assesses why China is implementing these export controls. It concludes that these are a calibrated response to U.S. and allied export controls on products and tariffs in other areas and represents a signaling exercise to caution the United States and others. In response to ongoing trade restrictions from the U.S. and its allies, China has demonstrated a willingness to impose strict measures on its exports and imports, including bans, as long as its manufacturing capabilities remain unaffected. Simultaneously, China’s export restrictions serve as a mapping attempt to gather information on the importers of these critical minerals and highlight its ability to leverage new economic and legal tools for weaponization of supply chains. To counter dependencies and chokepoints in the critical minerals supply chain, the paper closes with brief recommendations for the United States and its partners and allies.

II. USES OF GERMANIUM, GALLIUM, AND ANTIMONY, AND CHINA’S ROLE IN THEIR SUPPLY CHAINS

The initial 2023 export restrictions on germanium and gallium by the People’s Republic of China were perceived as retaliatory measures against the increasing restrictions on the export of advanced compute chips and semiconductor manufacturing equipment to China. Both germanium and gallium are critical to the semiconductor industry due to their unique chemical properties that optimize energy utilization and allow for wide-bandgap applications. Despite the restrictions announced in July 2023 and subsequent outright ban, the anticipated impact is manageable due to the diversity of global suppliers. That said, the costs are real. Prior to the ban, the U.S. Geological Survey projected losses of $3.4 billion to U.S. gross domestic product if both were banned simultaneously with the possibility of higher downstream impacts.

Germanium

Germanium, typically obtained as a by-product of zinc production, is essential for several high-tech applications. It is used in the production of fiber optic cables, advanced chips, and infrared optics. In military applications, germanium is crucial for night-vision devices and satellite imagery sensors. It also plays a significant role in low-carbon technologies, such as solar cells, which are vital for the transition to sustainable energy sources. Restricting germanium supply affects both military and civilian industries, depending on the availability of alternative suppliers.

China currently produces around 90 percent of the world’s mined germanium. The United States is over 50 percent dependent on germanium imports but does maintain domestic production from mines in Alaska and Tennessee. Besides 54 percent of its imported germanium coming from China prior to the export restrictions, the United States also sources germanium imports from Belgium and Germany. This diversification helps mitigate the impact of supply restrictions from China to some extent, and the U.S. Department of Defense has implemented new programs to aid in recycling and reuse of germanium, including salvaging sensor systems from older AH-64 Apache helicopters and M1 Bradley infantry fighting vehicles.

Gallium

Gallium, produced as a by-product of zinc and aluminum mining, is critical for semiconductors – including compound semiconductors and advanced defense systems for the United States. Gallium nitride (GaN) components are used in the U.S. Navy’s AN/ SPY-6 radar, the U.S. Marine Corps’ AN/TPS-80 G/ATOR radar, as well as Patriot and THAAD systems. GaN is also increasingly used in advanced microelectronics, satellites, radio communication devices, LIDAR, and LEDs. Semiconductor wafers made with gallium arsenide (GaAs) can operate at higher frequencies and are more heat-resistant than those made with silicon, and GaAs monolithic microwave integrated circuits have been used in electronic warfare systems and radar for forty years. The United States has a 100 percent import dependency for gallium but sources it from a diverse base: 26 percent from Japan, 21 percent from China, and 19 percent from Germany as of 2022. Despite China’s significant production (it controls 98 percent of low purity production as of 2024), the diverse supplier base somewhat mitigates potential risks.

Allied countries of the United States are enhancing their gallium production capabilities to reduce dependency on China. Japanese companies, while reliant on China for a portion of their gallium imports, can still refine globally available scrap to produce gallium. Japan plans to produce primary gallium through DOWA Metals and Mining, a company operating outside Chinese control. Germany’s Ingal Stade GmbH also announced plans to restart gallium production in 2021, increasing European production capacity. Additionally, Australia has potential as a supplier due to its existing zinc and bauxite sources, which are required for gallium production.

While the export restrictions on germanium and gallium have prompted the United States to enhance production with allies, the diverse global supplier base and ongoing efforts to increase production capacity in other countries help mitigate the impact of these restrictions and market prices have reportedly stabilized for both minerals. The full impact of the December 2024 export ban remains to be seen. However, according to Chinese customs data no shipments were made from China to the United States of wrought or unwrought germanium or gallium throughout 2024.

Antimony

In the case of antimony, China’s export restrictions caused its overall October 2024 shipments to plunge by 97 percent compared to September. Antimony is a key material for defense applications like armor-piercing ammunition, night vision goggles, and infrared sensors, and the United States is heavily import dependent on China. China’s antimony reserves are largely concentrated in the Xikuangshan district of Hunan province which has 2 million tons of reserves. Along with gallium and germanium, China banned antimony exports to the United States in December 2024. This sparked a significant market price increase. While germanium and gallium are more of a strong cautionary tale of Chinese import dependency and the antimony ban represents a serious concern, the export controls on graphite present a distinct set of challenges.

III. THE CASE OF GRAPHITE DEPENDENCY

The demand for graphite, both natural and synthetic, is expected to surge in support of global efforts in reducing greenhouse gas emissions through non-hydrocarbon energy provision, sustainable mobility, steel production, and digitization. In energy storage systems, graphite is used in lithium-ion batteries (LIBs), stationary batteries, lead-acid batteries, and fuel cells. It is also crucial in producing silicon for solar panels, rotor blades, and electric brushes for wind turbines. The electric vehicle (EV) industry, which plays an integral part in sustainable mobility, commands much of the graphite demand today. By 2040, the battery-related applications in the EV industry are forecasted to represent 65 percent of the total demand. Apart from the clean energy industries, specialty graphite is essential for certain semiconductor production, powering digitalization, and is increasingly demanded in advanced technologies such as aerospace applications, graphene, and pebble-bed nuclear reactors.

Salience of Graphite in the EV Industry

Within the EV industry, graphite is a critical component of the anodes in lithium-ion batteries. Its layered structure allows lithium ions to mobilize between layers, providing stability during charge and discharge cycles. This is essential for maintaining battery integrity and extending battery life. Despite the emergence of alternative battery technologies, such as sodium-ion, iron-air, flow, nickel-hydrogen, and liquid metal batteries, lithium-ion batteries remain the preferred choice for electric vehicles (EVs) due to their higher energy density and stability. With lithium-ion batteries showing an upward trend in demand, the use of graphite is only going to increase.

Carmakers are pushing to secure direct deals with battery makers and producers and processors of critical minerals like graphite in order to capture the supply for their own production. For example, in 2024, Tesla and several Korean battery makers, including LG, met with the Chilean government regarding lithium supply for the U.S. market. At the same time Chinese companies like BYD are looking to develop in-house battery supply chains to enable sale of cheaper models while protecting profit margins. Meanwhile, many EV companies in Vietnam, Europe, and the United States are missing sales targets and trading low. In a competitive market, securing production of critical minerals is integral. In this regard the demand for graphite and a scramble for production capabilities or source exploration arises in the horizon.

China’s Dominance in Graphite Production

China dominates the global graphite market, accounting for over 60 percent of flake graphite and nearly 80 percent of synthetic graphite production. This dominance is even more pronounced for value-added products such as spherical graphite and anode active material, where China controls more than 90 percent of global production. Chinese anode manufacturers like BTR, Shanshan, and Putailai supply leading battery companies like Panasonic, CATL, and LG Energy Solution, highlighting the interdependency of the global battery supply chain.

Countries like South Korea and Japan are particularly vulnerable to Chinese restrictions as they rely entirely on China for spherical graphite imports for battery anode production. While shipments for South Korea and even Germany were approved as of January 2024, approvals for the United States and India faced the prospect of denial in the immediate aftermath of the restrictions. The forms for approval in the restriction process require detailed analysis of the end-use and confidential details which have discouraged companies from sourcing graphite from China. However, despite a general decline in export volume, Chinese suppliers had continued to receive shipments for destinations like the United States, South Korea, and Japan in the months of January and February in 2024. China imposed tighter restrictions on graphite following the export ban on germanium, gallium, and antimony. However, this falls short of a complete ban.

Even though China is expected to face competition from Australia, North America, and Europe in future production capabilities, it will likely maintain significant control over the market. The United States has introduced the Inflation Reduction Act (IRA) to boost domestic manufacturing and develop localized battery supply chains in order to mitigate this dependency. The European Union’s Critical Raw Materials Act follows a similar suit. Countries like India are also moving to develop a role in the global battery supply chain. Despite these efforts, China remains a dominant player in the graphite market, with substantial natural and synthetic graphite production capabilities, making it a pivotal country in the global graphite supply chain.

Alternatives to U.S. Dependency on China for Graphite

In building resilient supply chains, veering away from a Chinese dependency, the United States has started building relationships with its allies and partners on sourcing natural graphite. Currently, the United States does not produce any natural graphite, but produced about 60-80 percent of the synthetic graphite it consumed in 2021. The EV industry in the United States, which is integral to increase in graphite demand, is mostly dependent on natural graphite due to its competitive advantages in lower greenhouse gas emissions and costs. Several companies have undertaken exploratory initiatives to develop natural graphite reserves and production capacities both inside the United States and within its allied countries.

Canada’s Graphite One’s Graphite Creek Project, located in Alaska, has the highest-grade and largest known large flake graphite deposit in the United States. A 2022 prefeasibility study projected mining 22.5 million tons of ore at the rate of 2,740 tons per day of carbon in graphite form. In response to increasing demand for EVs, Graphite One will further undertake feasibility studies and drilling projects to increase production of graphite concentrate to 10,000 tons per day. However, details of this project and a set timeline are yet to be determined.

The U.S.-based Westwater Resources’ Coosa Graphite Project is another potential source of natural graphite for the country. Situated in Alabama, this project conducted drilling programs in 2015 and 2022 that identified sources for near-surface high-grade graphite in the Alabama Graphite Belt. However, to reduce reliance on China, the United States cannot just bank on domestic sources. It will have to invest in increasing production capacities in resource-rich countries like Madagascar, Mozambique, and Brazil.

In 2022, Madagascar and Mozambique together accounted for 22.4 percent of U.S. graphite imports by volume. Additionally, the two countries along with Tanzania make up about 67 million tons of natural graphite reserves, while Brazil has 74 million tons, second only to China’s. Companies from the United Kingdom, Canada, and Australia have invested in expansion of old and creation of new graphite extraction and mining projects in Madagascar and Mozambique. Meanwhile, California-based Solar Star Battery Metals has started with its plant construction and development at the Santa Cruz graphite mine in Brazil. Despite these developments, the United States has to focus on increasing the value of imports from these countries. While Madagascar and Mozambique contribute 22.4 percent of U.S. graphite imports by volume, they only contribute 9.6 percent to the imports by value. This is because most of the region’s exports are lower-value products like flake and dust that need additional processing for EV batteries. In addition to highlighting China’s dominance in the graphite supply chain, Chinese export controls have set some wheels in motion for U.S. industrial and legislative action.

Impact of the PRC’s Graphite Controls on U.S. Industries and Legislation Export restrictions by the PRC have influenced graphite prices as short-term prices increased due to stockpiling and anticipated supply shortfalls. However, such price upticks have proven transient, with flake graphite prices stabilizing after initial increases. Moreover, as of September 2024, Chinese graphite exports continued to the United States, Japan, and South Korea as the top three destinations. Compared to September 2023, the volume of exports has decreased mainly due to decrease in exports to Japan and South Korea. There is also concern from industry experts that the PRC may reverse its graphite controls in the future. If North American companies undertake major investments in the graphite market now, they are at a risk of going bankrupt with underdeveloped resources as China floods the North American market with its graphite exports. Instead of entering a rush to develop domestic graphite plants, the United States should focus more on maintaining a floor price for battery-grade graphite made in North America.

Legislation in the United States is still very supply chain and import dependency focused. With regard to battery materials used in EVs, including graphite, the Biden administration introduced rules to prevent EV manufacturers from sourcing battery materials from China and other adversarial nations. These rules are a part of clean vehicle tax credits under the Inflation Reduction Act (IRA) of 2022. The new rules set a 25 percent ownership threshold for entities classified as foreign adversaries. However, subsidiaries of privately-owned Chinese companies in non-adversarial countries may be exempt if not controlled by the Chinese government. Starting in 2024, vehicles with battery components from these entities did not qualify for the tax credit.

Carmakers have expressed concerns of increased EV costs as it is difficult to exclude China in the graphite supply chains on such short notice. On the other hand, U.S. mining and recycling companies are advocating for a stronger stance against Chinese battery related imports to encourage domestic production of critical minerals. U.S. efforts to diversify its graphite supply chain and reduce dependency on Chinese imports form one part of the puzzle, but U.S. tariffs under President Trump complicate the trade picture. Export controls on graphite, along with germanium, gallium, and antimony, and others are a larger effort of the PRC effort to retaliate against export restrictions led by the United States and gather further information on the chokepoints China controls.

IV. EXPORT CONTROLS: THE PRC’S SIGNALING ATTEMPT

The PRC’s 2023-2025 export controls on germanium, gallium, and graphite were likely intended as strategic signals to the United States and its allies, such as Japan and the Netherlands. These moves highlight China’s capacity for economic coercion and its willingness to leverage control over critical mineral supply chains as a countermeasure to perceived or real economic and technological restrictions imposed by other nations. Until September 2024, there were no reports of transactions of critical minerals actually blocked, though some delays may have occurred due to bureaucratic license processing. This suggests that through the licensing restrictions, Chinese requests for information from exporters and their clients were also intended to gather information on the full network and leverage they held. However, as cautioned by the Chinese, subsequent tariffs and export controls by the United States and its allies led to a complete export ban of certain critical minerals from China.

The Chinese government has shown that it is ready to leverage economic tools, the degree and purpose of which depends on restrictions on its trade with the United States and allies. However, the need to balance export restrictions and import tariffs with domestic manufacturing and production capability remains important for Chinese leadership. In one latest round of import tariffs introduced by China, strategic items like high-end chips, pharmaceuticals, and aerospace equipment were not targeted.

The PRC’s actions are not unprecedented. Historically, China has used its dominance over critical materials to exert political pressure and influence. In September 2010, a Chinese fishing vessel rammed two Japanese Coast Guard vessels within Japan’s Senkaku Island territorial waters after refusing to vacate the area. The Chinese crew was detained, and the captain later tried under Japanese domestic law. The incident sparked a diplomatic crisis. In response, the PRC threatened to block rare earth exports for electronic applications to Japan, causing rare earth prices to skyrocket and forcing countries to seek alternative supplies. Japan was eventually able to diversify its imports. By 2021, it had reduced its rare earths dependency on China from nearly 100 percent to 60 percent by developing agreements with countries like Mongolia, Australia, Vietnam, and Australia.

Similarly, in 2017, the PRC disrupted commercial activities of South Korean firms in China, specifically Lotte Group’s supermarkets, in retaliation for South Korea deploying the U.S. manufactured THAAD missile defense system. In 2021, it stopped importing lasers from Lithuania in response to its recognition of Taiwan. Other cases of Chinese economic coercion have targeted Norway, Mongolia, the European Union, and Australia. These incidents exemplify China’s economic coercion, which now includes restricting exports of vital minerals.

China’s restrictions on antimony, graphite, gallium, and germanium are also retaliatory measures that came shortly after the United States introduced new controls to limit advanced chip exports. U.S. allies took similar steps. The Dutch government imposed restrictions on the export of semiconductor manufacturing equipment to China in 2023. Japan, too, meted out restrictions on deep ultraviolet immersion lithography tools and semiconductor manufacturing equipment in July 2023. The European Union started an anti–subsidy probe into Chinese EVs, weighing the option of imposing tariffs to protect their domestic markets against the cheap Chinese imports. Expert analysis suggests President Xi Jinping has shifted China toward a goal of transformation into a fortress economy that strives to shield the Chinese economy from any external shocks, given the current geopolitical constraints and integrated supply chain risks. China’s increased use of lawfare tactics in broader foreign policy has meshed with an expansion of its export control toolbox. It is logical to assume that mapping China’s critical mineral advantages and signaling risks to the rest of the world if Chinese interests are compromised is part of that strategy, regardless of the long-term intention behind the export control policy updates on these critical minerals.

V. CONCLUSION

China’s dominance over extraction and processing of critical minerals like gallium and graphite, essential for EV batteries, chips, and other technologies, gives it substantial leverage. By enacting export controls, China aims to demonstrate that it can disrupt supply chains critical to their markets and consumer base. These controls target inputs on key technologies, including those with defense and national security applications. According to the Head of the Nonferrous Metals Society of China, China’s prowess in rare-earth refining allows it to impose “reciprocal sanctions” on its competitors in light of their restrictive economic policies.

China’s export controls on critical minerals may not be an all-effective tool to clamp down on U.S. semiconductor chip production or its battery industry. Neither are the export controls on graphite, especially, meant to deny foreclose exports to the United States and its allies. However, the latest measures and flexibility of export bans and import tariffs serve as a warning shot to the United States and its allies, signaling potential further restrictions, and indicating that subsequent export controls, sanctions, or tariffs from Washington will not be met without costs. They can also act as coercive tools to secure favorable conditions for Chinese manufacturers and companies. However, as highlighted in the 2010 case of China’s threatening rare earth export restrictions to Japan, countries have the ability to diversify their supply chains when faced with restrictive economic policies. But it takes considerable time (10-20 years) to build new extracting and processing. While China’s export control measures may not immediately disrupt global supply chains, they highlight the growing risk of retaliation and the need for diversification.

The United States, in a bipartisan fashion, and its partners and allies should devote diplomatic and financial resources to expand the Mineral Security Partnership, and facilitate broader, forward looking public-private partnerships with and among allied and partner countries and firms to insulate critical technology markets from future shocks and embargoes by enhancing diversity of supply and strengthening resilience in both extraction and processing.

In March 2025, President Trump built on progress from the Biden administration to enhance critical mineral supply chains, including the CHIPS and Science Act, the Inflation Reduction Act, and Defense Production Act, and invoked emergency powers to boost domestic mineral production. More actions should be considered. Specifically, the United States can leverage the Trump administration’s executive orders on energy and critical minerals to include assessments for potential international partnerships and to replicate additional Strategic Mineral Recovery Initiatives of the type agreed with India with other partners. Second, it can offer reasonable technology transfer and know-how to Mineral Security Partnership Forum countries as an incentive for collaboration to develop mining or refining projects. Third, it should consider adopting and implementing a mineral security framework developed by Silverado Policy Accelerator to allow the United States Trade Representative to review petitions for Critical Mineral Agreements with the United States to facilitate additional projects. Fourth, it should expand the scope of the Supply Chains Resilience Initiative (SCRI) through the Export-Import Bank and the Development Finance Corporation to not only finance critical mineral projects as President Trump’s order required, but also include funds for last mile connectivity and supporting infrastructure for successful extraction or processing projects. Finally, it could continue to support the MINVEST public-private partnership to facilitate investment and offtaking agreements for critical mineral projects.

Implementing these and other critical mineral supply chain policy initiatives will help the United States and its allies ensure that their advanced technology manufacturing industries compete and prosper. Action and cooperation today among the United States and its partners make the possibility of a true Chinese hammerlock via export controls on critical minerals much less likely in the future.

Acknowledgements

The authors would like to thank Mahnaz Khan for her review, comments, and suggestions on an earlier draft of this paper. The paper is part of ORF America’s Technology Policy Program work. This background paper reflects the personal research, analysis, and views of the authors, and does not represent the position of the institution, its affiliates, or partners.

Cover image courtesy iStockPhoto: su tim.

Note: Citations and references can be found in the PDF version of this paper available here.