Special Report No. 5

Author: Aditya Ramji

EXECUTIVE SUMMARY

Energy security remains a cornerstone of the U.S.-India partnership, being vital for economic growth and national security. A U.S.-India Energy and Industrial Partnership should involve deploying energy technologies at scale, reducing concentrations in energy supply chains and manufacturing, and strengthening both the domestic industrial base and industrial corridor between the two countries. This will require a four-pronged approach involving: research partnerships to leapfrog to new battery chemistries and small modular reactors, among other emerging technologies; trade missions and technology transfers in strategic sectors, including automotive and battery technologies; public-private partnerships in areas such as lithium-ion battery and ancillary component manufacturing; and a bilateral track involving governments and financial institutions for funding strategic sectors.

The United States and India can expect an eight-to-tenfold increase in demand for batteries and critical minerals (such as nickel, copper, lithium, and graphite) by 2035. Addressing this demand will require joint resource mapping, capital deployment, and manufacturing and technology partnerships. Particular efforts must also be made on automotive and transportation technologies, including hydrogen fuel cells, advanced driving assistance, and drones. Furthermore, India’s expansion of natural gas, green hydrogen, and nuclear power in its energy mix present opportunities for collaboration, with advantages for the United States in cost-competitive electrolyzers and nuclear energy components. All of these steps will present opportunities for collaboration and investments involving the private sector and the two countries’ start-up ecosystems.

Introduction

India and the United States have strengthened their bilateral cooperation in the past two decades, built on the foundation of shared values and interests of security, economic prosperity, trade, and investment. The two countries reaffirmed their commitment to bilateral cooperation, launching the U.S.–India COMPACT for the 21st Century, emphasizing energy security, critical emerging technologies, and trade enhancements, in a joint statement during Prime Minister Narendra Modi’s visit to Washington in February 2025.[1] Recent initiatives have included cooperation on power and energy efficiency, responsible oil and gas, including hydrogen and biofuels, batteries, the inclusion of India in the Mineral Security Partnership (MSP), INDUS-Innovation, the initiative on Critical and Emerging Technologies (iCET), and more recently the U.S.–India TRUST (Transforming the Relationship Utilizing Strategic Technology) which cut across strategic sectors including defense and aerospace. 2025–26 will remain a crucial period to maintain and expand on the bilateral efforts, building on the shared goals of industrial policy and energy security.

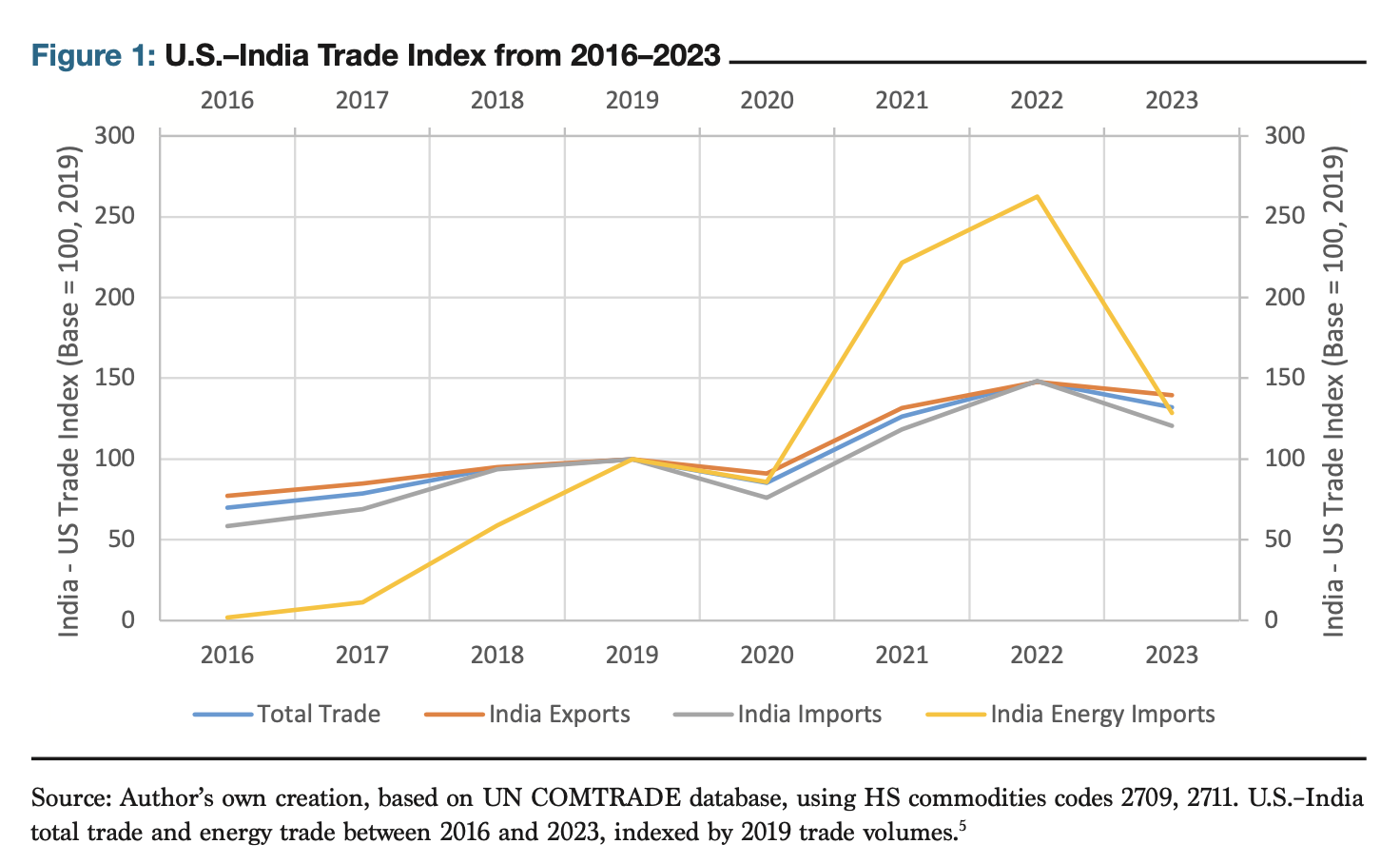

The United States and India have recently expressed intent to increase bilateral trade volumes to $500 billion by 2030, requiring double-digit growth in the next five years. Following this announcement, both countries have taken steps to negotiate a bilateral trade agreement. Bilateral trade was estimated to be around $129.2 billion in 2024, registering a robust 9.5 percent compounded annual growth rate since 2016. Since 2016, India has seen increasing energy trade with the United States, primarily imports, peaking at $14.7 billion in 2022, forming 28 percent of total Indian imports from the United States.

Energy security has been considered a cornerstone for economic growth and crucial for national security. Interestingly, both countries have seen 35–40 percent reduction in energy intensity economy-wide between 2000–2022 and had a similar share of renewables in power generation of about 22 percent (as of 2022). In terms of final energy consumption, about 54.4 percent comes from coal, oil, and natural gas in India, whereas the same constitutes about 72.2 percent in the United States. India remains a net energy importer (approximately 36 percent of its total energy supply) compared to the United States who is a net energy exporter (approximately 8 percent of its total energy production).

Observer Research Foundation America (ORF America) hosted a series of closed-door, invitation-only workshops with Indian and American energy and climate experts to better understand actionable opportunities for the United States to cooperate with India. Following the 2024 Indian and U.S. elections, ORF America closely tracked policy developments and changes in the strategic priorities of the newly elected governments. This special report builds on the outcomes from the workshops, recent policy announcements, and recommends a proposal for a U.S.-India Strategic Energy and Industrial Partnership. This partnership could leverage respective strengths and the bilateral relationship to meet the following objectives: 1) develop and deploy energy technologies at scale at home and abroad; 2) reduce concentration in energy supply chains and manufacturing of new energy technologies of the future; and 3) continue to strengthen both the domestic industrial base and the industrial corridor between the two countries.

REDUCING CONCENTRATION AND INCREASING COMMERCIALIZATION IN TECHNOLOGY AND ENERGY SUPPLY CHAINS

With the Inflation Reduction Act, the United States already has about 72 gigawatt hours (GWh) of lithium-ion battery manufacturing capacity as of 2024, and over 36,000 tons (as of 2023) of battery recycling capacity domestically attracting some of the world’s largest investments. India is currently building capacity for over 60 GWh of battery manufacturing that is expected to be operational in phases from 2027 onwards. By 2035, estimates suggest that demand for batteries would be around 1000–1200 GWh and 160–380 GWh in the United States and India, respectively. The rapid growth in energy technologies has put the spotlight on battery supply chains including the availability of critical raw materials.

Global demand for critical minerals such as lithium, nickel, copper, graphite, and rare earths is expected to double by 2035 from 2024 levels in a business-as-usual scenario, with demand increasing by a factor of 3 to 5 times, in an accelerated global energy transition pathway. In this context, lithium demand for India and the United States battery market is expected to increase 8 times by 2035, from 2024 levels. Minerals such as nickel, copper, and graphite also have over half of their demand coming from base industrial sectors including infrastructure and steel, forming a strong foundational base to economic growth. Both the United States and India are net importers of critical minerals. The global landscape on critical minerals, while rooted in the context of energy transition technologies and manufacturing, has expanded to include other strategic sectors such as defense, aerospace, and high-value electronics, including semiconductors, further highlighting the importance of critical minerals as dual-use inputs.

A two-pronged strategy will be needed to secure the necessary raw materials from global markets for short- and medium-term demand in the next 5–10 years, while they continue to develop potential domestic resources that can cater to long-term supply, even under accelerated permitting timelines. During the deliberations, experts framed the emergence and vitality of critical minerals as integral to a new industrial revolution. In this context, it is crucial to highlight four areas: resource mapping, processing and refining, technology development, and recycling. Both the United States and India have critical mineral strategies, with India announcing its National Critical Minerals Mission (NCMM) in February 2025, with many overlapping objectives, including accelerating domestic mineral exploration projects and recycling.

Participants from the U.S. government emphasized that India is among the only credible partners that can help break China’s dominance in clean energy manufacturing and strategic industries, including batteries, electrolyzers, and solar cells, as well as intermediary inputs such as refined or processed materials. Participants from both countries agreed that prioritizing diversification from China should be a key bilateral effort, in addition to strengthening bilateral cooperation. Participants at the New Delhi workshop, while echoing similar sentiments, emphasized that the bilateral partnership should also identify next-generation technologies that create a comparative advantage, an objective that aligns with the earlier bilateral iCET program and the newly announced U.S.–India TRUST (Transforming the Relationship Utilizing Strategic Technology) initiative. The newly announced research partnership between the Anusandhan National Research Foundation in India and the United States National Science Foundation can play a strategic role in advancing joint research and development (R&D) projects.

In terms of specific minerals for further bilateral attention, the Washington workshop highlighted that both the United States and India had import dependency across the mineral value chain. One such example is graphite, which was highlighted as a viable option to expand U.S.–India critical minerals trade. One expert pointed out that as of 2023, the United States sourced 48 percent of its graphite imports from China at a higher cost than India’s graphite export price. Materials such as graphite are used across sectors ranging from steel to consumer goods to batteries, and thus, even if India-sourced graphite can supply to non-clean technology sectors (given its ore quality) in the United States, it can relieve part of the commodity price pressure. A strategy of identifying mineral dependencies and an economy-wide approach of sourcing diversification can be beneficial for both countries. Experts at the United States workshop also highlighted that of the twelve strategic defense minerals for the United States, ten of them overlap with India’s priorities as well, while overall, nineteen minerals overlap across the critical mineral lists of the two countries.

While the development of upstream mineral extraction projects can have a longer gestation period, developing critical minerals refining capabilities can be achieved relatively faster in both countries. The Washington workshop participants expressed that the bilateral partnership could also evaluate the possibility of developing joint refining bases in Southeast Asia and Africa, beyond their own respective domestic capacities. However, India-sourced or Indian-company extracted and processed minerals are not currently Inflation Reduction Act (IRA) compliant, which calls for a bilateral critical minerals agreement that could make India an operationally compliant strategic partner.

In both the New Delhi and Washington workshops, participants discussed industrial policy efforts in the two countries, highlighting the focus on onshoring manufacturing through various policy measures requiring higher domestic content requirements. However, both countries will have to rely on international cooperation to ensure that they remain competitive and have market access while participating in global supply chains. Despite certain trade and economic tensions, the United States and India have comparative advantages that present an opportunity to create a critical minerals industrial corridor, mainly due to viable costs of capital and labor in India, and advanced scientific capabilities in both countries. Further, efforts such as the Supply Chain Resiliency Initiative by the U.S. EXIM Bank, providing targeted financing to develop critical mineral projects from trusted partners, could be leveraged by India.

In January 2025, the U.S. Department of Defense established the Strategic and Critical Materials Board, which will comprise members from other departments, including Energy, State, Commerce, and Interior, to ensure secure and resilient access to materials and minerals and to identify innovative solutions for complex industrial base challenges. For a successful partnership, India would also need to consider its institutional framework on critical minerals to ensure effective engagement and implementation.

While both countries focus on the development of domestic industrial bases that can cut across the value chain to improve their competitiveness, five key areas of bilateral cooperation emerge on critical minerals and supply chains:

Advancing resource mapping through collaboration between the United States Geological Survey and the Geological Survey of India

Joint deployment of capital in mineral assets and refining facilities in domestic and international markets

Technology partnerships for battery manufacturing and recycling, building on the Strategic Mineral Recovery Initiative

International cooperation through multilateral platforms, including the MSP and Quad, to ensure supply chain diversification

Joint track and trace approaches to identify areas of vulnerabilities, investment opportunities, and technology development.

EXPANDING TIES IN THE AUTOMOTIVE INDUSTRY AND TECHNOLOGY DEVELOPMENT

The United States and India are major automotive hubs and the world’s second and third largest markets, respectively. Technology advancements will be key to maintaining the global competitiveness of the automotive sector in both countries. This makes the automotive sector between the two countries an important potential sector of cooperation, and should be part of the ongoing trade discussions.

In the past, major U.S. automakers such as Ford, General Motors, and Navistar have had strategic investments in the India market, while Indian companies such as Mahindra & Mahindra Ltd. and Tata Sons have been making inroads in the United States, with the former having its North America Technical Center headquartered in Michigan.

Beyond vehicle manufacturing, automotive components trade has been robust between the two countries. While 27 percent of India’s total automotive component exports are to the United States (as of 2024), India remains the 9th largest trading partner in this sector with the United States. While around half of the component imports to the United States come from Mexico and Canada, India remains a key player in the Mexican automotive industry, with 6 percent of component exports from India, as well as most major Indian component manufacturers having factories in Mexico, thereby indirectly catering to the U.S. automotive market.

Further, both markets are expected to continue witnessing electric vehicle (EV) sales, strengthening opportunities for technology cooperation and investments in EVs, EV components, and electronics. The United States has built a strong capability around high-voltage EV powertrains since 2021, while India has shown its capabilities in innovation and cost optimization. Infrastructure development for EV charging also remains a key area for cooperation, with the United States already implementing advanced policies.

Recent bilateral cooperation in road transportation has been largely around electric mobility, through technical assistance driving EV adoption, deployment of electric transit buses, and assessing the investment landscape to facilitate capital flow in the e-mobility sector. For the next phase of e-mobility deployment, United States workshop participants looked to the trucking sector, where various global logistics players are transitioning their truck fleets in both countries, with automotive original equipment manufacturers making significant investments in electric, fuel cell, and hydrogen-internal combustion engine (ICE) technologies.

As sub-national governments in the United States continue to deploy electric and low-emission buses for transit and school buses, there is limited manufacturing capacity domestically, which provides an opportunity for Indian e-bus manufacturers to consider investments in the United States. The efforts of the Michigan Economic Development Corporation (MEDC), the state’s government investment promotion unit, to bring more Indian businesses to the state, including the automotive sector, is a good example.

United States workshop stakeholders agreed that ambitious industrial policies can and should be aligned to aid this pillar of cooperation around the automotive industry and technology development, including e-mobility, alternative fuels, hydrogen, and other new emerging technologies, to ensure that the respective sectors in both countries continue to remain globally competitive. This takes further significance, especially in the face of aggressive, cost-competitive Chinese automotive products, namely electric vehicle exports to global markets.

Based on the deliberations, key areas of cooperation include:

Expanding automotive manufacturing in both countries, including joint ventures, foreign direct investment (FDI) by the U.S. and Indian companies.

Technology access and development for advanced automotive technologies, including electric vehicles, hydrogen fuel cells, and hydrogen ICE powertrains for trucks, advanced driving assistance (ADAS) technologies, among others.

Expanding transportation cooperation to include aviation and shipping sectors, including sustainable aviation and marine fuels, drones, VTOL aircraft, etc.

ADVANCING DEVELOPMENT IN EMERGING FUELS, INCLUDING HYDROGEN AND NUCLEAR COOPERATION

As both countries consider energy security goals, certain shared priorities emerge: (i) ensuring affordable and reliable energy for end use sectors; (ii) advancing grid reliability and resiliency; and, (iii) increasing share of nuclear power in the mix. In India’s case, three key strategies in its energy security pathway include:

Expanding natural gas to 15 percent share of the energy mix from the current 6 percent

Domestic production of 5 million metric tons (MMT) of green hydrogen by 2030

100 gigawatts (GW) of installed nuclear power capacity by 2047 with focus on small modular reactors.

Natural gas will play a key role in India’s energy security pathway in the near future. As India looks to increase its share of natural gas, it will continue to rely on imports, which complements the U.S. policy on expanding liquefied natural gas (LNG) exports. India’s natural gas demand saw a 10 percent annual increase in 2024, driven by rapid expansion of infrastructure, especially for residential and transportation sectors. Since 2019, the number of compressed natural gas (CNG) stations for transport have quadrupled, while the number of residential gas connections have more than doubled, with a push towards clean urban transportation and access to clean cooking fuels. By 2030, the number of CNG stations and residential connections will almost double including a 50 percent expansion in the gas transmission grid.

India’s energy imports from the United States have consistently increased since 2016, primarily driven by LNG, reaching a peak in 2022. India and the United States have reaffirmed their commitment towards increasing energy trade including natural gas and investments in infrastructure involving private sector in both countries. With India’s increasing push for gas infrastructure and demand potential, the United States could emerge as a strategic energy supplier for India, with long term security of both the resource as well as in terms of prices.

Natural gas takes further significance for India as it looks to scale hydrogen production. Beyond India’s 5 MMT target of green hydrogen production by 2030, it also aims to become an exporter of green hydrogen. Hydrogen demand is steadily increasing in various sectors including industries, ports, steel manufacturing, and transportation, especially the marine and aviation sectors. However, hydrogen is still a nascent industry and has challenges including high costs to the end user and a lack of sufficient infrastructure.

Experts agreed that efficient production, distribution networks, and global markets must be leveraged to incorporate hydrogen technologies at scale. Experts agreed that leveraging low-cost clean energy in both the United States and India can help reduce the delivered cost of electricity in the production cycle. Moving hydrogen production closer to consumption areas is another solution to reduce costs, and a clear short-term strategy. Hydrogen for transportation remains uncertain due to lower costs of battery electric and conventional ICE vehicles, and existing unreliability in hydrogen infrastructure.

The United States currently has an annual hydrogen production capacity of about 10 MMT, most of it currently being grey hydrogen, which is produced from natural gas, using steam methane reforming. This emits around 3–5 kg CO₂e per kilogram (kg) of hydrogen produced, compared to the green hydrogen threshold of less than 1 kg CO₂e. In the case of India, the definition of green hydrogen is set at no more 2 kg of CO₂e per kilogram of hydrogen produced. These thresholds are important as they bring forth a clear understanding of the potential for hydrogen cooperation between the two countries. As India looks to scale up hydrogen deployment, a cost-effective pathway will include a mix of grey and green hydrogen in the near to medium term. With India’s relatively less stringent green hydrogen thresholds, the role of natural gas-based hydrogen production would be significant, increasing demand for natural gas. This offers a unique convergence of cooperation on both natural gas and hydrogen, between the two countries.

Prior to 2025, the two countries have been collaborating under the Renewable Energy Technology Action Platform (RETAP), to achieve their respective goals of reducing the cost of green hydrogen. Going forward, rather than integrating hydrogen across sectors, experts emphasized that its implementation should focus on select industries such as steel, ammonia, and fertilizers. For instance, Indian steel manufacturers are actively exploring green steel production to stay competitive and carbon-compliant in global markets, especially with the announcement of the green steel taxonomy by India’s Ministry of Steel. Electrolyzer costs are significantly cheaper in India than in the United States, and one expert argued that the existing United States and India partnership should be explored to expand its manufacturing in both countries. Long-term electricity grid storage is another viable use case for hydrogen, although its demand will not arise for another decade. Hydrogen is an important piece in the global fuels narrative, with significant investments from the oil and gas industry, but it is imperative to continue focus on its research and development before scaled implementation across sectors.

Nuclear power has been relatively stagnant in India at about 1.2 percent of its total energy supply, compared to 9.8 percent in the United States. India announced an ambitious Nuclear Energy Mission in February 2025, with the goal of achieving 100 GW of installed nuclear power capacity by 2047, with a focus on research and development of Small Modular Reactors (SMRs). The United States has always focused on nuclear energy as a key part of its energy security strategy, launching the Advanced SMR R&D Program in 2019. After a long gap, this opens a strategic opportunity for U.S.–India cooperation on nuclear energy, including private sector investment and technology licensing from American companies to India, which has also been emphasized in the U.S–India joint statement in February 2025. Building on the previous U.S.–India iCET program and the new TRUST initiative, a specific avenue of civil nuclear cooperation will be critical. This will enable the two countries to realize the full potential of the 2005 Civil Nuclear Agreement, including specific measures such as amendments to the Civil Liability for Nuclear Damage Act 2010 by India and the removal of restrictions on Indian nuclear entities and technology exports by the United States. The regulatory clearance approved by the U.S. Department of Energy to Holtec International, a U.S. firm, to transfer SMR technology to India in March 2025 is a significant step in that direction.

Based on the deliberations, key findings include:

Scaling hydrogen deployment through a combination of grey and green hydrogen to manage costs including prioritizing end-use sectors such as steel, ammonia, and fertilizer.

Leveraging cost competitive electrolyzer manufacturing in India to expand manufacturing in both countries.

Advancing a renewed strategic opportunity for U.S.–India cooperation on nuclear energy, including private sector investment and technology licensing from American companies to India.

With India’s increasing push for gas infrastructure and demand potential, the United States could emerge as a strategic energy supplier for India, with long term security of both the resource as well as in terms of prices.

DELIVERING FINANCE BY SPURRING PRIVATE SECTOR INVESTMENT

Emerging markets have the greatest economic growth potential and, with stable economic principles, offer an attractive home for capital investment. India remains among the most attractive markets for investment potential, with a robust gross domestic product growth of 5–7 percent annually, attracting over $1 trillion cumulatively in FDI since 2000. India ranks 39th in the Global Innovation Index 2024, rising from 80th in 2015 and 40th in the World Competitive Index 2024. These factors, coupled with India’s growing skilled workforce, large consumer market, and strong macroeconomic principles make it a strong investment destination.

In the period from 2000–2024, FDI from the United States to India totaled about $69 billion, being a leading market for American firms in areas such as e-commerce, aviation, railways, telecommunications, food processing, and heavy equipment.

India’s commitment to clean energy transitions brings with it a market potential of $1.1 trillion. According to the International Energy Agency (IEA), India’s financing requirements to meet its energy transition goals of 2030 and 2070 is a staggering $160 billion per year. Recent initiatives announced during state visits, the G20, Quad (India, United States, Japan, Australia) summits, Indo-Pacific Economic Framework (IPEF), and at other forums, have been positive indicators of finance and investments continuing to remain a high priority for bilateral and multilateral cooperation.

United States workshop participants noted several avenues being pursued by the U.S. government to deploy capital towards India’s energy transition, particularly through the U.S. Development Finance Corporation (DFC). India is currently the largest market for DFC at 10 percent with $4.3 billion exposure, with the aim of capitalizing on clean energy transition, transportation, and job creation. Of this, $1.6 billion is dedicated to clean energy projects.

In particular, the DFC’s financial instruments include guarantees and support mechanisms to attract private sector investment in sectors that are usually not bankable, i.e., real or perceived risk is too high for the private sector to invest. A combination of policy and financing mechanisms has resulted in significant success stories for electric buses and solar photovoltaic manufacturing. These success stories offer important lessons that can and should be applied to other sectors and technologies such as batteries, alternative fuels, efficient cooling, and supply chains. For example, managing cooling demand in India through efficient technologies and software is one way to manage surging power demand in the country.

While Washington workshop participants discussed efforts through DFC as a bright spot, New Delhi participants offered a more measured assessment of current bilateral and multilateral efforts. Indian participants agreed that India’s finance needs for its energy transition are in orders of magnitude larger than other developing countries. No one country, government, or institution will be the source of all this financing, so efforts from development finance institutions like the DFC and multilateral development banks like the World Bank by themselves will not be sufficient but can play a key role in derisking the inflow of private capital. Consequently, external private sector funding and foreign direct investment must be mobilized in the strategic sectors, especially as domestic capital inflows in India are not sustainable.

Bilateral or multilateral finance efforts must account for India’s size and complexity, including Indian federalism and sub-national engagement. For example, Indian participants suggested both governments explore partnerships to secure social protection funding for coal-dependent regions, especially as renewable energy in India gets cheaper, it will phase out non-renewable sources of energy such as coal plants. Moreover, another area to grow cooperation is engagement with state-owned enterprises in India, which span sectors beyond privately developed renewables and drive much of the energy transition in the country, including minerals, natural gas, hydrocarbons, nuclear, among others. In terms of target sectors for investment, New Delhi workshop participants also noted that Indian solar and e-mobility sectors are relatively mature. They stressed that new investments from international public funds should be redirected into sectors like grid scale energy storage, offshore wind, and green hydrogen that need more public sector support to encourage private investment.

In the context of clean energy manufacturing, investment, and innovation, the Washington workshop participants agreed that the United States must evaluate developments in the Indian private sector in tandem with governmental efforts. Along with the rise of global Indian companies, its start-up ecosystem is making strides in industries including critical minerals processing, battery manufacturing, hydrogen production, and e-mobility. On the other hand, India has used its Production-Linked Incentives (PLI) schemes to drive strategic private investment in sectors like battery manufacturing, electronics and components, and solar, among others, attracting close to $19 billion worth of investments between 2021–2024. Stakeholders agreed that it has had a significant impact in kickstarting the transition to create an enabling environment to increase private sector investment.

Both countries must therefore create channels for the private sector to address their impediments and concerns. The International Trade Administration (ITA) has been taking steps to address such concerns and deepen the U.S.–India commercial partnership. A key ITA focus area is clean energy supply chains, particularly solar energy. Improving the traceability of India–U.S. solar supply chains is imperative to reduce dependence on Chinese solar exports. Collective action through multilateral efforts, including Australia and Brazil, are necessary to address high-risk upstream issues in the solar value chain. Similar opportunities exist in critical minerals and battery supply chains. With the new TRUST initiative, strategic sectors such as defense and aerospace also offer significant market opportunities for private sector investment and have the potential to accelerate the development and deployment of critical future technologies.

Key findings of the workshops include:

Expanding financing opportunities beyond global Indian industries to include the start-up ecosystem which is making strides in critical and emerging energy technologies.

Exploring a U.S.–India investment vehicle expanding the Production-Linked Incentives (PLI’s) scheme to create a finance multiplier effect for critical and emerging energy technologies.

Improve the traceability of India–U.S. supply chains to reduce dependency and vulnerabilities.

THE PATH FORWARD: A U.S.–INDIA STRATEGIC ENERGY AND INDUSTRIAL PARTNERSHIP

Drawing on the workshop outcomes, it is clear that the United States and India are best positioned to leverage their respective strengths and their bilateral relationship to: 1) develop and deploy energy technologies at scale at home and abroad; 2) reduce concentration in energy supply chains and manufacturing of new energy technologies of the future; and 3) continue to strengthen the both the domestic industrial base and the industrial corridor between the two countries.

To mutually strengthen strategic objectives, increase private sector investments, and capture economic opportunities, the United States and India should launch a U.S.–India Strategic Energy and Industrial Partnership that builds upon 20+ years of successful bilateral cooperation. This initiative should prioritize three key areas: (i) accelerate commercialization of strategic technologies and battery supply chains; (ii) expand automotive technology cooperation and investment; (iii) advance development of emerging fuels including hydrogen and nuclear.

For a long-term and successful partnership, industrial policy, technology development, and global competitiveness remain at the center, and achieving these concurrent objectives will require a four-pronged approach:

Research, Development, and Innovation: the partnership should reorient current research partnerships to focus on next generation emerging and critical technologies including leapfrogging to new battery chemistries, future automotive technologies, hydrogen and nuclear SMR. Mirroring the recent U.S.–India Defense Acceleration Ecosystem (INDUS-X), the launch of INDUS Innovation aims to advance industry–academia partnerships and foster investments for new and emerging sectors including space and energy.

Trade and Investment: U.S.–India two-way goods trade in the automotive sector totaled $3.8 billion and $600 million in the battery supply chain as of 2023. Bilateral trade and investment have the potential to reorient battery supply chains away from China and potentially meet U.S. domestic battery production deficits, as well as open opportunities for technology transfer from the United States to India. Specific efforts could include trade missions, feasibility assessments, and export guarantees to advance cooperation in the specific sectors identified. Further, specific provisions within the trade framework to enable technology transfer in strategic sectors as well as flow of specific critical minerals and advanced batteries, export and import of nuclear technologies, hydrogen fuel and electrolyzers, could go a long way in building a global diversified supply chain for both countries.

Public-Private Partnerships: Under the bilateral partnership, launching a specific U.S.–India batteries task force bringing together major American and Indian industry players along with both governments, trade groups and civil society, could serve to catalyze strategic partnerships and investments needed to realize the other three pillars. India could provide an alternative regional hub for lithium-ion battery and ancillary component manufacturing in the Indo-Pacific. Additionally, specific tracks on automotive industry cooperation, and alternative fuels (including hydrogen and nuclear) would strengthen bilateral cooperation, opening new market opportunities. In the context of such partnerships, leveraging existing institutional mechanisms between the two countries can help accelerate the timelines, leading to tangible outcomes in the near term.

Finance: Beyond leveraging financial instruments from U.S. DFC, U.S. Export-Import Bank and U.S. Trade and Development Agency (USTDA) to crowd in private sector investment, the two countries can also setup a Finance for Strategic Sectors track, that brings together financial institutions and private investors in both countries periodically to clearly identify a pipeline of projects for potential investment prioritizing the sectors identified.

A U.S.–India Strategic Energy and Industrial Partnership has the potential to transform bilateral cooperation and grow private sector cooperation. Consequently, there is a need to break down past and existing U.S.–India partnerships and identify long-term goals and potential domestic measures that could hinder initiatives at an operational level. Partnerships need to account for these risks and vulnerabilities from both countries, and guard against them in the long-term scenario. Trust building is essential, and both countries need to take steps to ensure policy continuity and build towards a multi-dimensional long-term partnership that transcends short-term geopolitical tensions. Lastly, while domestic objectives around energy transitions may change, both countries will benefit from prioritizing industrial policy outcomes and global competitiveness, especially as global markets continue to focus on clean energy technologies and supply chains.

ACKNOWLEDGEMENTS

The author would like to thank Shayak Sengupta, Medha Prasanna, Caroline Arkalji, and Jeffrey D. Bean for their research and writing in support of this project, and their review of an earlier draft of this paper. The paper is part of ORF America’s Clean Energy and Climate work. This background paper reflects the personal research, analysis, and views of the author, and does not represent the position of the institution, its affiliates, or partners.

Cover image courtesy iStockPhoto: Eyematrix.

Note: Citations and references can be found in the PDF version of this paper available here.

- White House, “United States–India Joint Leaders’ Statement,” White House, February 13, 2025, https://www.whitehouse.gov/briefings-statements/2025/02/united-states-india-joint-leaders-statement/. ↩︎