Background Paper No. 33

BY Anit Mukherjee and caroline arkalji

Executive Summary

Biofuels are an increasingly indispensable complement to electrification and energy efficiency strategies in the global energy transition, particularly for the Global South. With fossil fuels projected to remain critical for transportation in developing economies, biofuels offer a lower-carbon alternative that is compatible with current vehicular technologies, but also capable of decarbonizing hard-to-abate sectors such as aviation and shipping. Their compatibility with existing infrastructure, reliance on locally available feedstocks, and potential to enhance rural livelihoods underscore their relevance for greenhouse gas (GHG) mitigation, energy security, and inclusive development.

Yet significant challenges remain. The cost gap between biofuels and fossil fuels persists, particularly for advanced fuels like biojet and biomethane. Feedstock sustainability poses another constraint: expansion may conflict with food security, biodiversity, and land-use goals. Innovation remains underfunded, especially in second- and third-generation biofuels, and finance for large-scale deployment is unevenly distributed.

To address these barriers, the paper recommends three priorities: (i) expanding integrated policy frameworks that include blending mandates and sustainability certifications; (ii) accelerating technological innovation through R&D investments and public-private partnerships; and (iii) strengthening global cooperation and cross-learning, particularly through platforms like the Global Biofuels Alliance. These actions are essential to aligning biofuel deployment with net zero goals and advancing a just, resilient energy transition.

I. INTRODUCTION

Biofuels are increasingly regarded as vital to the process of energy transition, especially in the countries of the Global South. With a growing urban population, the energy demand from household consumption and transportation will increase significantly in the foreseeable future. Even with the share of renewable energy from solar, wind, hydrogen, and geothermal sources rising over time, fossil fuels will continue to remain an essential part of the energy mix, especially for the transportation sector in developing countries.

Biofuels offer an alternative to reduce the carbon intensity of energy demand both in the short and long run. They can have a lower carbon footprint than fossil fuels and can significantly decarbonize transportation, especially in hard-to-abate sectors such as aviation. Biofuels are highly adaptable and compatible with existing infrastructure, can use residues from agriculture, and offer additional sources of income for rural communities. Finally, several countries such as Brazil and India have existing policies to increase the use of biofuels and to enhance production capacity to meet the demand for biofuels. Over time, global collaboration and investment in new technologies have the potential to accelerate the transition to more sustainable methods that depend less on primary inputs from agriculture, such as sugarcane, corn, soybeans, and palm, which are still the base for the majority of global biofuel production.

On the supply side, greater uptake of biofuels will depend on production capacity, distribution network, and regulatory mandates. While ethanol is approaching cost parity with fossil fuels in countries like Brazil, biomethane and biojet fuel for aviation can be twice as expensive. The availability of feedstock is a significant challenge as it often competes with food production. Expanding biofuels production using current technologies can also lead to land use conflicts, deforestation, and biodiversity loss, underlining the urgency of investing in new technologies to augment the output of second and third-generation biofuels that do not jeopardize food security.

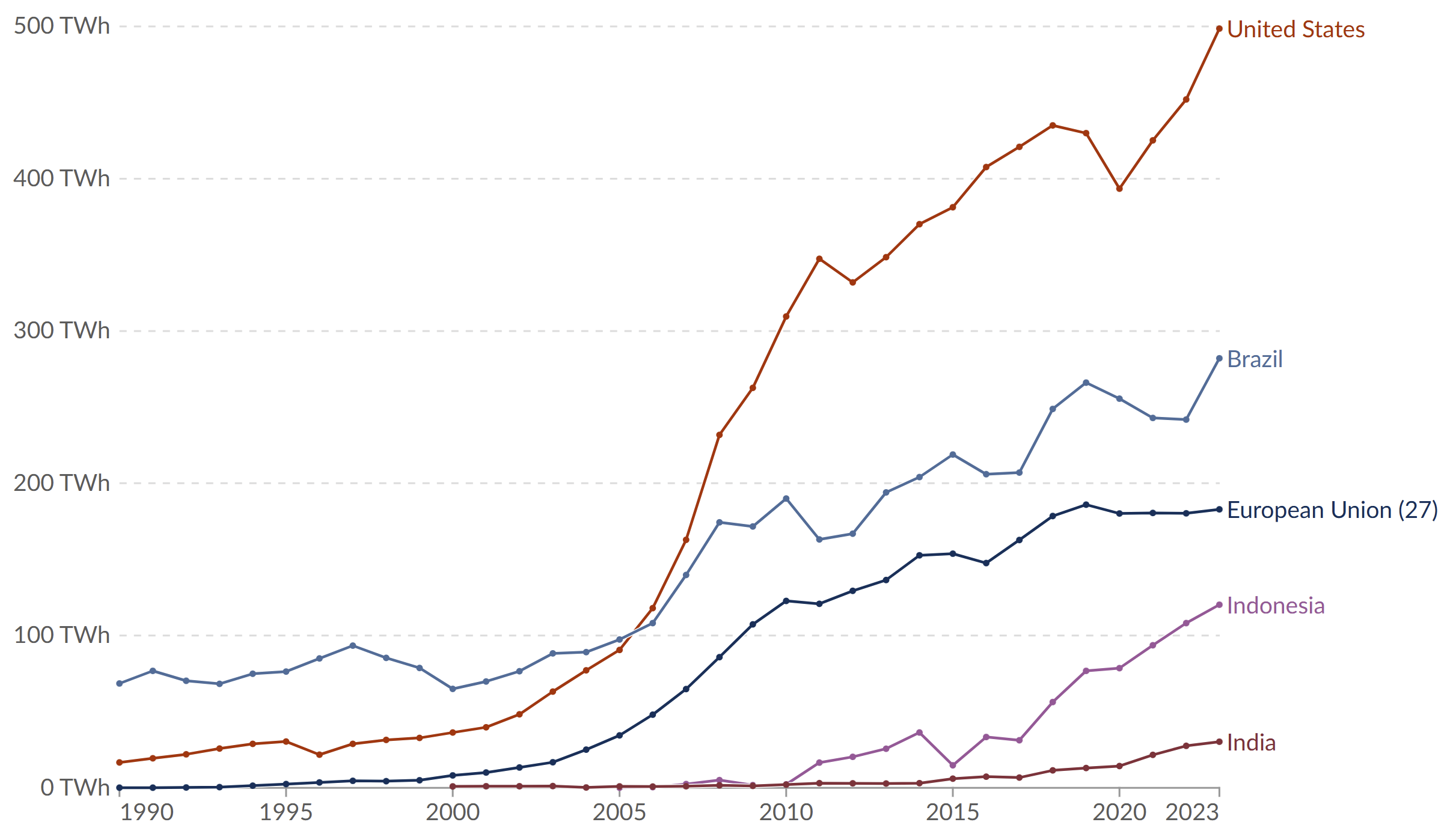

Currently, 80 percent of the global production of biofuels is concentrated in the United States, Brazil, Europe, India, and Indonesia. Countries like India, Brazil, and the United States have adopted policies that support supply growth. The policies have sustained annual growth rates above 20 percent during a 5-year timeframe, resulting in Brazil having 21 percent of its transport energy provided by biofuels while the United States has 7 percent. In India, ethanol accounted for 6 percent of the energy used in gasoline vehicles in 2022, twice the levels recorded in 2019. However, these markets comprise only half of the worldwide transport fuel demand. For there to be a sustainable increase in biofuels, new markets will have to be developed, while current ones will have to expand their production. Consequently, compacts like the Global Biofuel Alliance (GBA), launched during India’s G20 presidency in 2023, can serve as knowledge platforms that foster collaboration and work on ensuring secure and cost-effective biofuel supply while shaping robust standard settings and certifications for nations and other stakeholders.

This paper argues that biofuels represent a viable alternative within the energy mix for a country’s comprehensive energy transition, especially in the Global South. It will explore the bioenergy market and its dynamics, examine countries' sustainable policies and mandates, and assess the GBA's role in fostering innovation to scale production and align the sector with Net Zero Emissions goals and targets.

II. The Role of Biofuels in the Energy Transition, Market Dynamics, and Investment

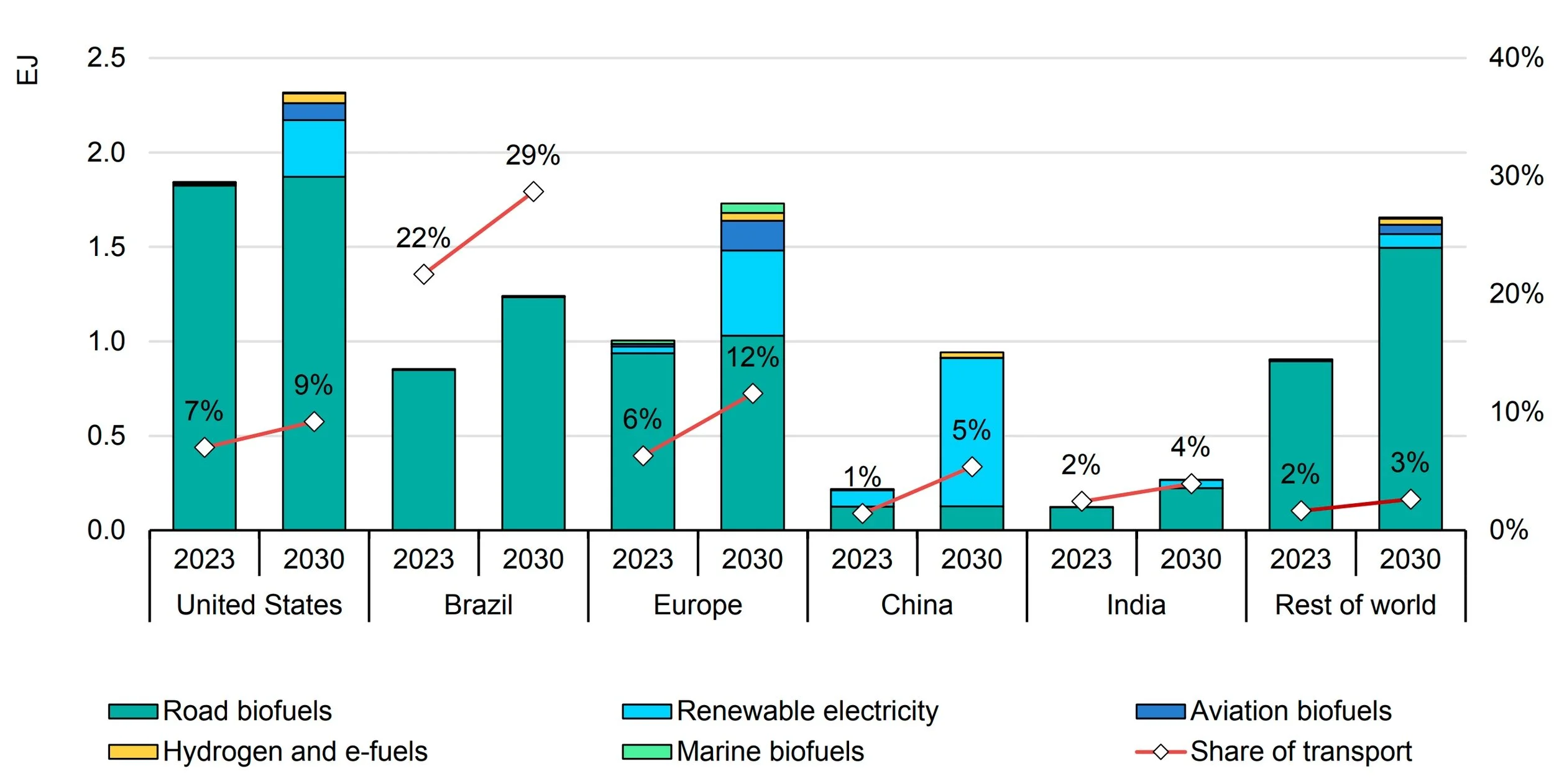

Sustainable biofuel production is still not on course with the Net Zero Emissions (NZE) by 2050 Scenario. In the NZE Scenario, sustainable biofuel production needs to triple by 2030 to successfully abate emissions from current and future vehicles, such as trucks, planes, ships, and passenger cars, that have few other mitigation measures. To narrow the gap between biofuel production and deployment with the NZE goals, there is a need to strengthen existing country-level policies to establish new biofuels blending targets, advance technology, and develop new markets.

As the world works to decrease its dependence on fossil fuels, road transport is the closest to meeting the NZE Scenario targets as a result of greater use of biofuels and an increased share of electric vehicles. High-income countries have progressively augmented the electrification of their transportation systems, in addition to EVs constituting 25 percent or more of new vehicle sales. In the Global South's low- and middle-income countries, biofuels derived from crops and a small set of waste and residues like the used cooking oil and tallow offer immediate, affordable alternatives for decarbonizing the transportation system. Biofuels derived from other wastes and residues, such as cellulosic ethanol and algae, are costly, thus slowing their adoption until now.

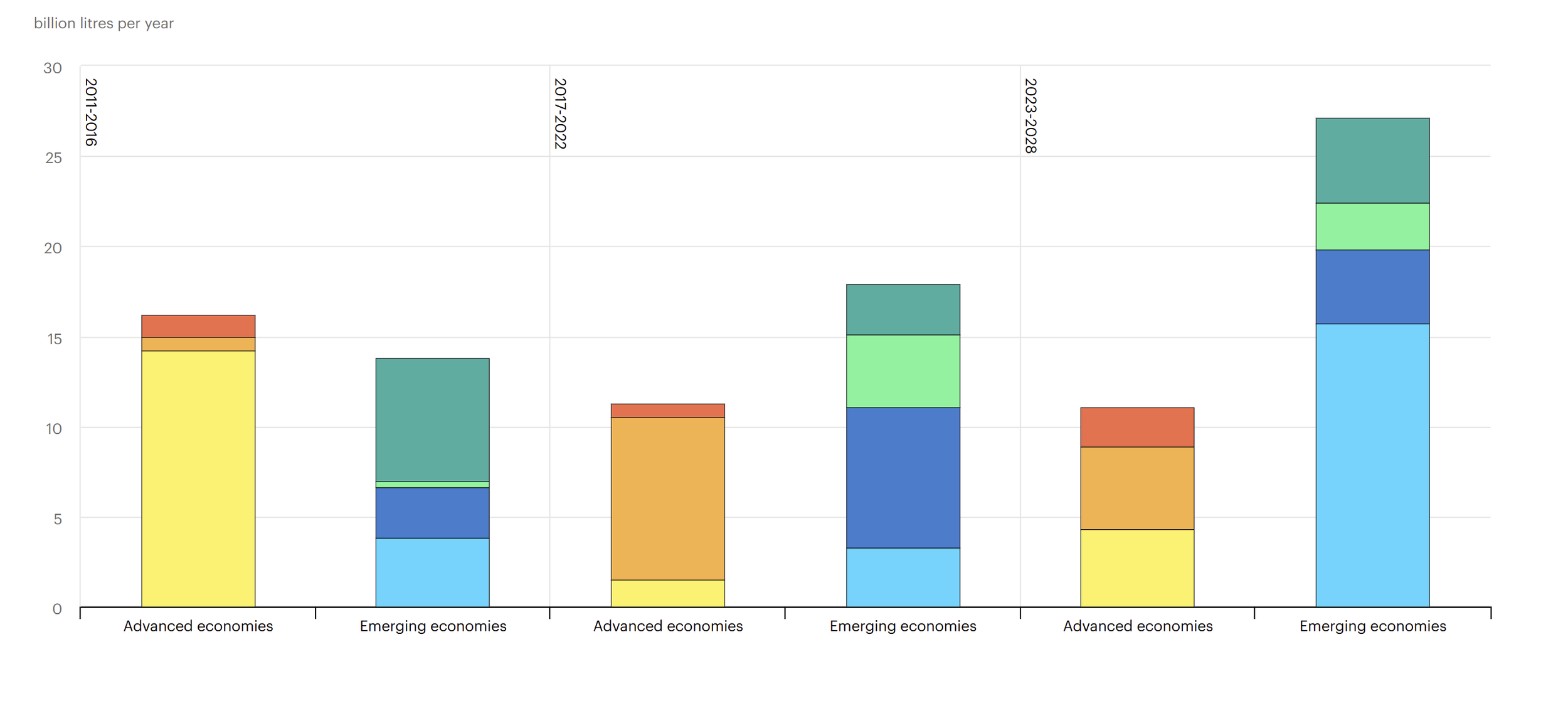

Figure 1. Renewable Fuel Demand by Region and Transport Subsector, Main Case 2023-2030

Source: International Energy Agency, “Renewables 2024: Analysis and forecast to 2030,” International Energy Agency, 2024. License: CC BY 4.0.

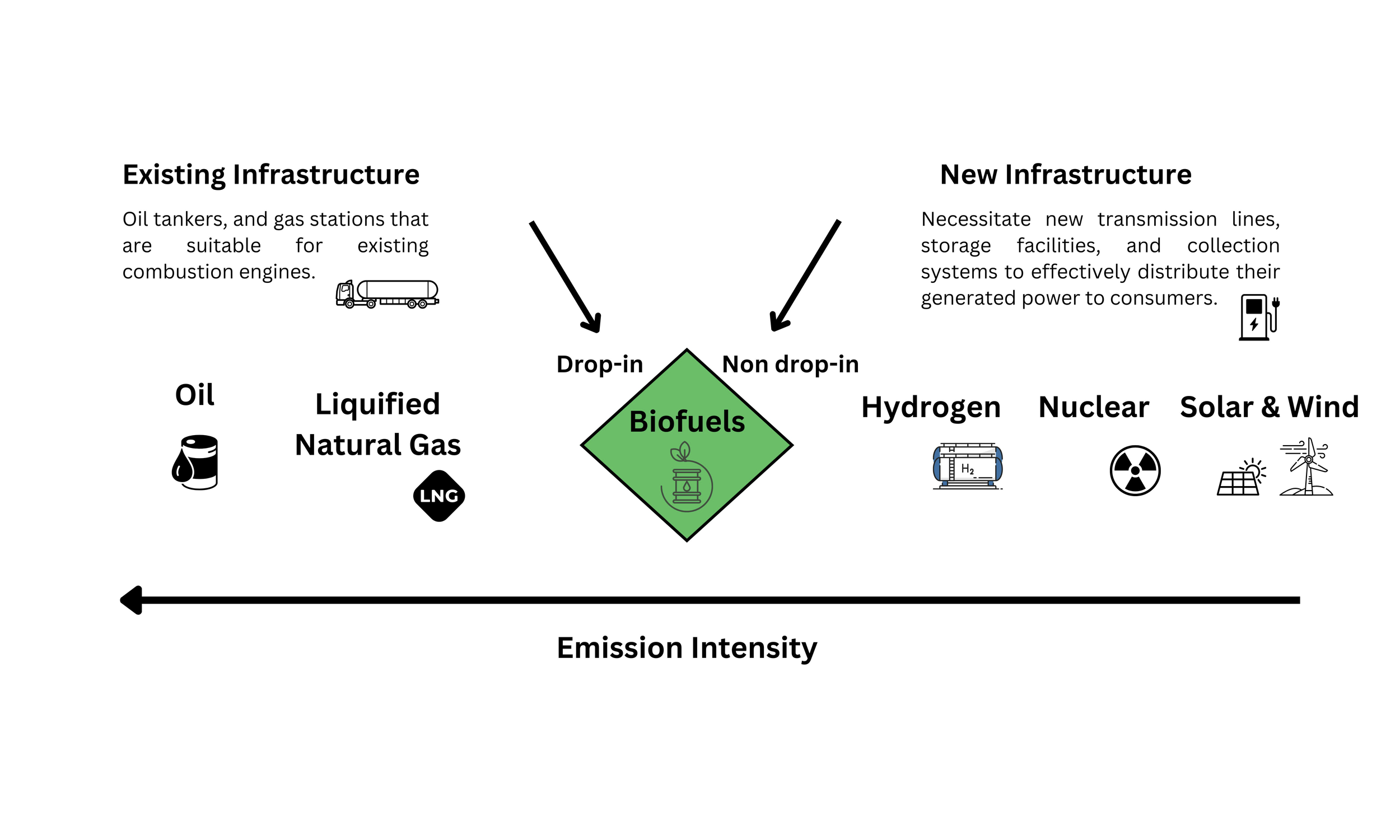

Most biofuels mandates have a minimum greenhouse gas emissions (GHG) intensity requirement, ensuring biofuels are at least 50 percent lower emitting than fossil fuels and as much as 80 percent for some fuels. Additional advantages include biofuels serving as “drop-in” alternatives for fossil fuels, as their use integrates well with a good portion of the existing petroleum and natural gas infrastructure (Figure 2). In South American countries, including Argentina, Brazil, Colombia, and Guatemala, replacing gasoline and diesel with ethanol and biodiesel could reduce GHG emissions by up to 84 percent. Studies indicate that significant reductions in GHG emissions for biofuels are possible in countries in Africa and Asia, up to 78 percent for biodiesel and 81 percent for ethanol compared to conventional fuels.

Figure 2. Energy Transition and Infrastructure Challenges

Source: Author’s own creation. Note: Biofuels and hydrogen can have similar emission profiles.

While there is substantial evidence that the available sustainable feedstocks could triple biofuel production by 2030, over 80 percent of that production occurs in only four countries: the United States, Brazil, Europe, and Indonesia. African nations, for instance, are nearly absent from the biofuels market, representing less than 1 percent of global production and consumption. Although current producers frequently expand their output, to align biofuel production with the NZE scenario, demand and supply must increase, necessitating the development of new markets and a boost in existing production.

The global biofuels market share surpassed $113 billion in 2024 and is projected to reach $261 billion by 2034, growing at a compound annual growth rate of 6.9 percent from 2025 to 2034. The increased demand is driven by heightened concerns about energy security, economic development, sustainability goals, climate policies, and government incentives to decarbonize various sectors. A total of 58 countries have mandated ethanol blending with gasoline, while 48 countries have set biodiesel blending requirements.

Figure 3. Global Biofuels Production (2009-2023)

Source: Our World in Data, “Biofuels Production,” Our World in Data. License: CC BY. Notes: Total biofuel production per year is measured in terawatt-hours (TWh). Biofuel production includes both bioethanol and biodiesel.

Certain emerging markets — Brazil, Indonesia, and India — are leading growth in biofuel production through mandates and incentives, primarily in road transport, which is expected to increase fuel demand by 27 billion liters. However, despite setting targets for the use of biofuels in aviation and maritime sectors, these countries have yet to implement concrete mandates and incentives to support these ambitions. In contrast, advanced economies like the United States and the European Union (EU) members are leading growth in air and maritime shipping, respectively, driven by strong mandates. By 2030, the aviation and shipping industries are projected to account for 75 percent of the new biofuel demand, mainly in the United States and the EU, spurred by policy incentives.

This growth is further reinforced by the International Maritime Organization’s (IMO) Net-Zero Framework, which introduces a global fuel standard requiring ships to progressively reduce their greenhouse gas fuel intensity and establishes an economic mechanism where high-emitting vessels must purchase remedial units while low-emission ships may receive financial rewards. While advanced economies are currently driving the transition, there is untapped potential for emerging economies to expand into the maritime biofuels market by adopting similar regulatory and incentive structures.

While U.S. mandates under the Inflation Reduction Act (IRA) remain uncertain, the EU has set a target to reach 14.5 percent renewable energy in transportation by 2030, setting specific targets for biofuels and hydrogen, including a 2 percent aviation fuel blend by 2025. India’s 2022 update to its National Biofuels Policy has accelerated targets for blending ethanol and biodiesel. Brazil’s 2024 Fuel of the Future program aimed at boosting investment, including sustainable aviation fuel (Figure 4).

Figure 4. Biofuel Demand Growth for Advanced and Emerging Economies (2011-2028)

Source: International Energy Agency, “Five-year biofuel demand growth for advanced and emerging economies, main case, 2011-2028,” International Energy Agency, 2024. License: CC BY 4.0.

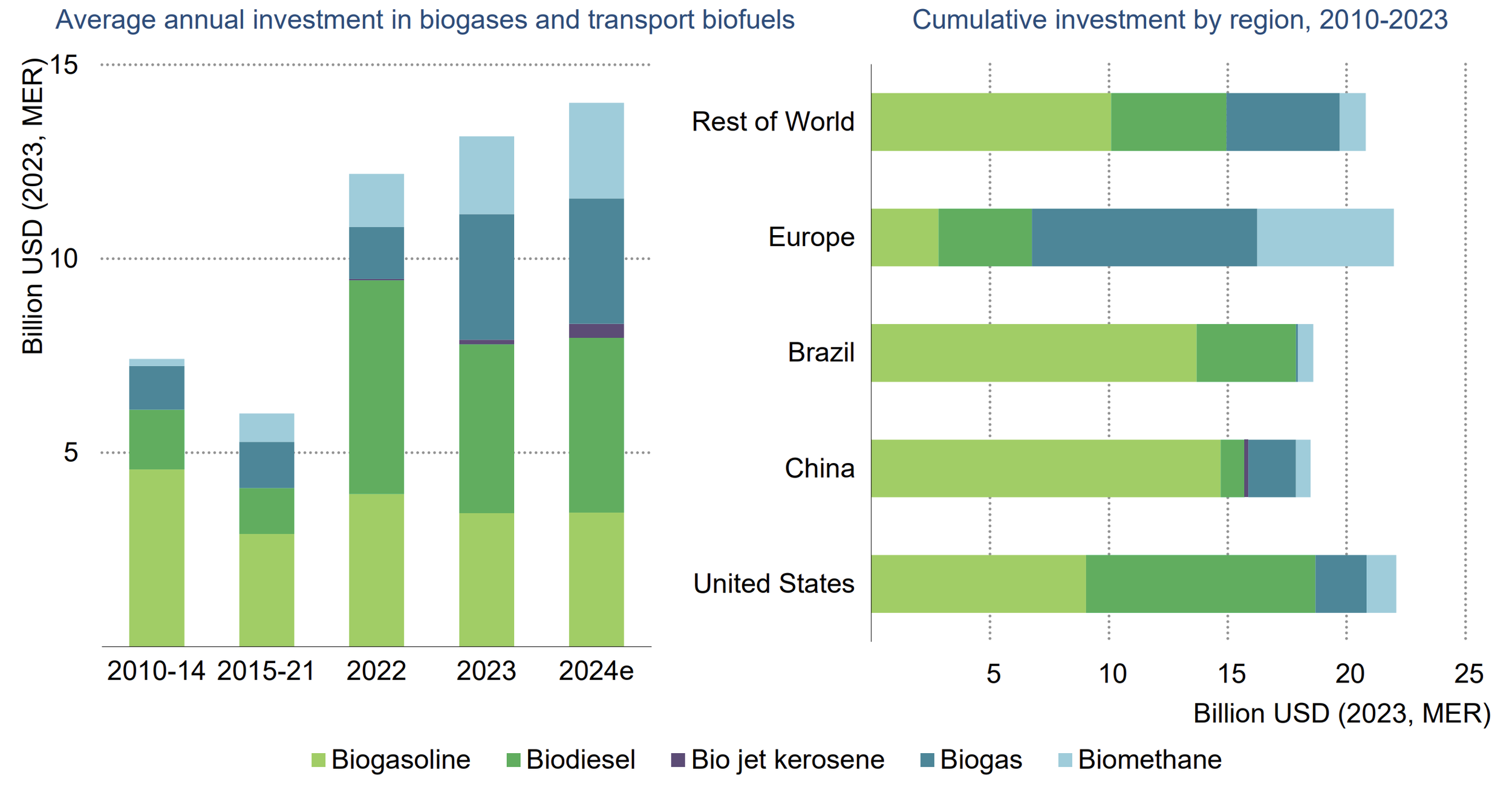

Private sector investments have also played an essential role in advancing the global biofuels industry. In 2023, the net amount of power generated by transport biofuels increased to a decade-high level, attributed to an 8 percent rise in investment. Although several traditional biofuel projects have been announced recently, such as Brazil’s Grupo Potential investing $109 million to increase its annual biodiesel production capacity from 900 million to 1.62 billion liters, most new investments in the biofuels sector are now directed toward expanding the production of so-called drop-in fuels. These include renewable diesel (HVO), biojet, and biomethane, which are chemically similar or identical to the fossil fuels they replace and can be used without engine or infrastructure modifications. In contrast, bioethanol, biodiesel, and biogas generally require blending or equipment adjustments and thus are not considered true drop-in fuels. For example, Raízen, Brazil’s largest sugar and ethanol producer, recently unveiled plans to invest R$11.5 ($2) billion in constructing nine second-generation ethanol (E2G), biogas, and biomethane plants across the country, of which only biomethane would be classified as a drop-in fuel.

Figure 5. Growth in Private Bioenergy Investment

Source: International Energy Agency, “World Energy Investment 2024,” International Energy Agency, June 2024, https://www.iea.org/reports/world-energy-investment-2024, License: CC BY 4.0.

III. International Collaboration on Biofuels and Lessons from the Global South

International cooperation, involving the joint action of nations, organizations, and stakeholders, is crucial to realizing biofuels' full potential. Emerging markets in Latin America and Asia are experiencing robust growth in their biofuels sectors. The increasing demand for sustainable energy, abundant local resources, and ample land for biofuel production fuels this growth and showcases the potential for further development.

The Global Biofuel Alliance and Its Priorities

Indian prime minister Narendra Modi launched the GBA at the G20 Summit in Delhi in 2023. The alliance, which includes governments, international organizations, and industries, brings together the world's biggest biofuel consumers and producers. Its 24 member countries include the United States and Brazil, the world’s largest and second-largest biofuel producers, respectively. It builds on existing global initiatives such as the Clean Energy Ministerial Biofuture Platform, the Global Bioenergy Partnership, and the Technology Cooperation Program that have advanced international biofuel cooperation over the past four decades.

The alliance's three key priorities are to identify and develop high-potential markets for the sustainable production of biofuels, to accelerate technology deployment to commercialize biofuels, and to establish performance-based sustainability frameworks. Global alliances like the GBA are essential in balancing biofuel adoption with climate goals. While biofuels offer a low-carbon alternative to fossil fuels, their impact depends on the technologies and processes countries and industries use to produce them. Without careful implementation, production risks could undermine climate change mitigation efforts.

To succeed in these priorities — attracting public and private sector investment and advancing the commercialization of innovative conversion technologies — a complete life cycle assessment of biofuels is essential to determine whether these fuels reduce greenhouse gas emissions. The GBA can set the directions for the entire biofuel supply chain upstream (feedstock and land use), midstream (conversion pathways), and downstream (blending and deployment) to prevent any additional environmental degradation. Our review points to a trio of key lessons for the GBA to be an effective instrument to support the adoption of biofuels as a key objective of a just and equitable energy transition led by the Global South. As we explain below, those are implementing strong regulations, promoting technological innovation, and advancing cross-learning.

Lessons from the Global South

Strong Regulatory Frameworks, Standards, and Targets

Governments utilize various tools, including blending mandates, excise taxes, subsidies, tax credits, and fiscal incentives, to narrow biofuel cost gaps, boost production, and shield consumers from price fluctuations. Financial incentives like tax credits, loan guarantees, and subsidies help mitigate the higher production costs of biofuels, attract investment, lower market barriers, and accelerate biofuel adoption. Renewable fuel standards and blending targets create steady biofuel demand by requiring fixed volumes or percentages in fuel mixtures. To tackle sustainability concerns, feedstock regulations prevent deforestation and biodiversity loss, while certification programs such as the International Sustainability and Carbon Certification (ISCC) establish sustainability standards.

Brazil is a global leader in biofuels, producing 23 percent of the world's supply in 2021, with a strong regulatory framework supporting its biofuel sector. The country’s biofuel policies, such as the RenovaBio, aim to reduce greenhouse gas emissions in the transportation sector by promoting the production and use of biofuels. RenovaBio includes a certification system that rewards producers for their carbon efficiency, enabling them to trade decarbonization credits (CBIOs) on the stock exchange. These initiatives are part of Brazil's commitment to meeting its climate targets under the Paris Agreement, reducing emissions, and boosting investment in biofuels through innovative market-based mechanisms.

India has also made significant strides in biofuel development with its National Biofuels Policy, which targets a 20 percent ethanol blend by 2025-2026 and a 5 percent biodiesel blend by 2030. The country’s Ethanol Blending Program (EBP) has improved ethanol supply and reduced fuel import reliance. India is working towards self-sufficiency in biofuels, supported by new standards introduced in 2023 by the Bureau of Indian Standards. These standards aim to boost production and industry practices as India moves toward its long-term energy goals, including achieving net zero by 2070.

Meanwhile, Indonesia has focused on enhancing its biodiesel sector, using its abundant palm oil resources. The country aims to increase its biodiesel blending rate to 50 percent by 2028 and has introduced the Indonesia Sustainable Palm Oil Standard (ISPO) to ensure sustainability in palm oil production. This framework aligns with domestic and international regulations to strengthen the palm oil sector’s competitiveness while contributing to emission reduction targets.

Promoting Technological Innovation To commercialize the advanced biofuels necessary to align with the NZE scenario, the rate of technology deployment must increase fifteen-fold by 2030 compared to 2021 standards. To achieve this, efforts in technology development and innovation are crucial for enhancing land productivity, optimizing the use of existing marginal land, and improving the collection of waste and residues from feedstocks compatible with current biofuel technologies. Brazil, India, and Indonesia are leading the way in biofuel innovation, integrating research with industry to bolster energy security, sustainability, and economic growth.

Brazil's biofuel growth has been backed by research led by Embrapa, a state-owned research corporation connected to the Ministry of Agriculture of Brazil. Embrapa focuses on increasing feedstock productivity without deforestation. Fermentation, bagasse recycling, and land restoration innovations optimize agricultural waste use. With over 40 million hectares of degraded pastureland, Brazil has significant potential to expand its biofuel production. Embrapa collaborates with companies such as Petrobras to develop low-carbon products, including biofuels, green chemicals, and fertilizers. Other partnerships, such as with Acelen, which operates the Mataripe refinery, involve cultivating the macaw palm for large-scale renewable fuel production. The project seeks to establish clear environmental and social guidelines, create 90,000 direct and indirect jobs, and generate over $1.3 billion in annual income for the involved communities.

India has also led biofuel production technology by investing $17 million in 75 joint biofuel projects, emphasizing sustainable biofuels, carbon capture, and smart grids. Funding for clean energy has surged, resulting in 5,000 compressed biogas (CBG) plants and pilot projects for hydrogen-methane fuel. The government also backs enzyme research for 2G ethanol and bioenergy research centers.

Indonesia has advanced biodiesel research since the 1990s, with institutions like LEMIGAS and BPPT developing biodiesel production from palm oil, used cooking oil, and jatropha. Research on pilot-scale production and engine trials led to small- and medium-scale biodiesel plants for testing and quality refinement. Once standards were met, regulations enabled commercial production. The biodiesel sector expanded with government and investor support, leading to the formation of APROBI (Indonesia Biofuel Producer Association) in 2006 to strengthen industry collaboration and policy development on biofuel usage in Indonesia.

Advancement of Cross-Learning One significant barrier to expanding biofuel use is the absence of internationally recognized sustainability standards. This mainly concerns the debate over land use for biomass cultivation and food security, which suggests that land necessary for food production may be diverted to biofuel production. Brazil, India, and Indonesia are engaged in international biofuel initiatives to establish standards for sustainable practices and promote adoption while considering local conditions in emerging producing countries. Brazil participates in the Biofuture Platform Initiative, the IEA Bioenergy Technology Collaboration Program, and bilateral agreements like its memorandum of understanding on Bioenergy Cooperation with India. Indonesia, a member of several biofuels initiatives, recently accepted India’s Global Biofuels Alliance invitation, emphasizing biofuels' growing role in international cooperation.

Leading bioenergy producers demonstrate that biofuel demand can be satisfied. However, solutions must be customized to each country’s conditions, considering resource availability, regulations, and technology. Since no nation can independently serve the biofuel market, international collaboration through platforms like the GBA is essential for promoting global biofuel sustainability. Countries like Brazil, India, and Indonesia have established strong institutional frameworks and policies that can serve as models for countries in the GBA and others.

IV. Conclusion

Biofuels emit significantly lower levels of greenhouse gases than conventional fossil fuels, making them a key solution for reducing greenhouse gas emissions and an essential step in the energy transition process. They also enhance energy security by reducing the reliance on imported fossil fuels and increasing domestic production, which can increase countries’ energy system diversification and stability. Additionally, biofuel can strengthen rural economies by creating jobs and new revenue streams for farmers while establishing sustainable credentials and standards that ensure ecologically and socially appropriate production methods.

Although advancements have been made in the biofuels sector, fully realizing their potential and aligning production with the Net Zero Emissions Scenario will require ongoing efforts across industries and stakeholders. Drawing from emerging market models, which have been leading biofuel growth, the Global Biofuels Alliance can play a crucial role in addressing the institutional challenges that new biofuel-producing countries face, enabling collaboration, fostering policy development, and promoting sustainable frameworks.

By fostering global dialogue, supporting national bioenergy legislation, and collaborating with existing international initiatives, the Global Biofuels Alliance can help streamline the integration of biofuels into the worldwide energy mix. The alliance can also facilitate access to global financial resources, ensuring that countries and industries have the support needed to enter and compete in the biofuels market. Through coordinated efforts, the alliance can strengthen biofuel trade, drive investments in innovative technologies, and promote responsible policies and sustainable frameworks. By expanding market opportunities and ensuring sustainable resource use, the Global Biofuels Alliance can accelerate the transition to a resilient energy future, aligning with global sustainability goals and emission reduction targets.

Acknowledgements

The authors would like to thank Jeremy Moorhouse, Patricia Audi, and Jeffrey D. Bean for their review, comments, and suggestions of an earlier draft of this paper. The paper is part of ORF America’s Shaping our Common Agenda initiative, supported by the Children’s Investment Fund Foundation (CIFF). This background paper reflects the personal research, analysis, and views of the authors and does not represent the position of the institution, its affiliates, or partners.

Cover Image courtesy iStockPhoto: scanrail.

Note: Citations and references can be found in the PDF version of this paper available here.